Gold ETF (GLD) Holdings Lowest Since 2008, Amid Declining Volatility & Hedge Fund Negativity

Gold ETF (GLD) Holdings Lowest Since 2008, Amid Declining Volatility & Hedge Fund Negativity

Gold Holdings in World's Top ETF Reach Lowest Since 2008

by Debarati Roy , Bloomberg

Investors are shunning gold again, sending holdings in the world's largest exchange-traded product backed by bullion to the lowest since December 2008.

Assets in the SPDR Gold Trust (GLD), which counts billionaire John Paulson as its biggest holder, dropped to 780.19 metric tons yesterday, as about $2.6 billion was wiped from the value of the fund in the past two months.

After reaching a six-month high in March, gold has dropped 7 percent as the U.S. economy recovered from a winter slowdown. Prices plunged 28 percent last year, the most since 1981, after some investors lost faith in the precious metal as a store of value, and more than $73 billion was erased from global ETPs.

"There are really no fundamental reasons to be invested in gold," James Cordier, the founder of Optionsellers.com in Tampa, Florida, said in a telephone interview. "The safe-haven premium has dropped because the economy is improving."

Gold futures for June delivery traded at $1,294.30 an ounce on the Comex in New York. Prices have tumbled about 33 percent from an all-time high of $1,923.70 in September 2011.

Bullion's 30-day volatility has dropped to the lowest in more than a year, and the metal in May has traded within a range of about $44. Futures in New York are little changed this month, and the declines in price swings signal that gold is poised to break out of its range, said Cordier, who sees futures falling to $1,150 by the end of the year.

"Right now, we are in the direction of directionless," Sterling Smith, a futures specialist at Citigroup Inc. in Chicago, said in a telephone interview. "The market will break out from this very narrow trading range, and given the general performance of the market, I bet on the downside."

Hedge-Fund Bets

Holdings in global gold ETFs slumped 869 tons in 2013, data compiled by Bloomberg show. An additional 100 tons may be withdrawn this year, Barclays Plc forecasts.

Hedge funds cut their net-long position in gold by 8.3 percent to 94,329 futures and options in the week ended May 13, U.S. Commodity Futures Trading Commission data show. Short holdings betting on a decline rose 10 percent to 31,283, the highest since February. The bearish wagers have more than doubled since mid-March.

An accelerating U.S. economy means prices will fall to $1,050 in 12 months, Goldman Sachs Group Inc. forecasts. U.S. claims for jobless benefits reached the lowest since 2007 in the week ended May 10, Labor Department data show. Spending at American retailers held steady in April after a surge in the previous month that put economic growth on track to pick up in the second quarter, Commerce Department figures showed May 13.

Ukraine Tension

While analysts at Goldman "remain bearish" on gold, "the uncertain outlook in Ukraine may continue to delay this move lower," the bank said in a report May 13. Prices gained 7.7 percent this year after Russia annexed the Crimean peninsula in March, followed by clashes between pro-separatists and government forces in nearby eastern regions of Ukraine.

Paulson kept his gold holding in the SPDR Trust unchanged in the first quarter, having told clients in November that he personally wouldn't invest more money in his bullion fund. The firm has left its stake unchanged for three consecutive quarters.

"A lot of people had written off gold, saying it will move lower this year, but then tension in Ukraine helped keep prices supported," Walter "Bucky" Hellwig, who helps manage $17 billion at BB&T Wealth Management in Birmingham, Alabama. "Gold is in a base-building formation here, and it seems like it's ready for a big move."

Courtesy of Bloomberg.com

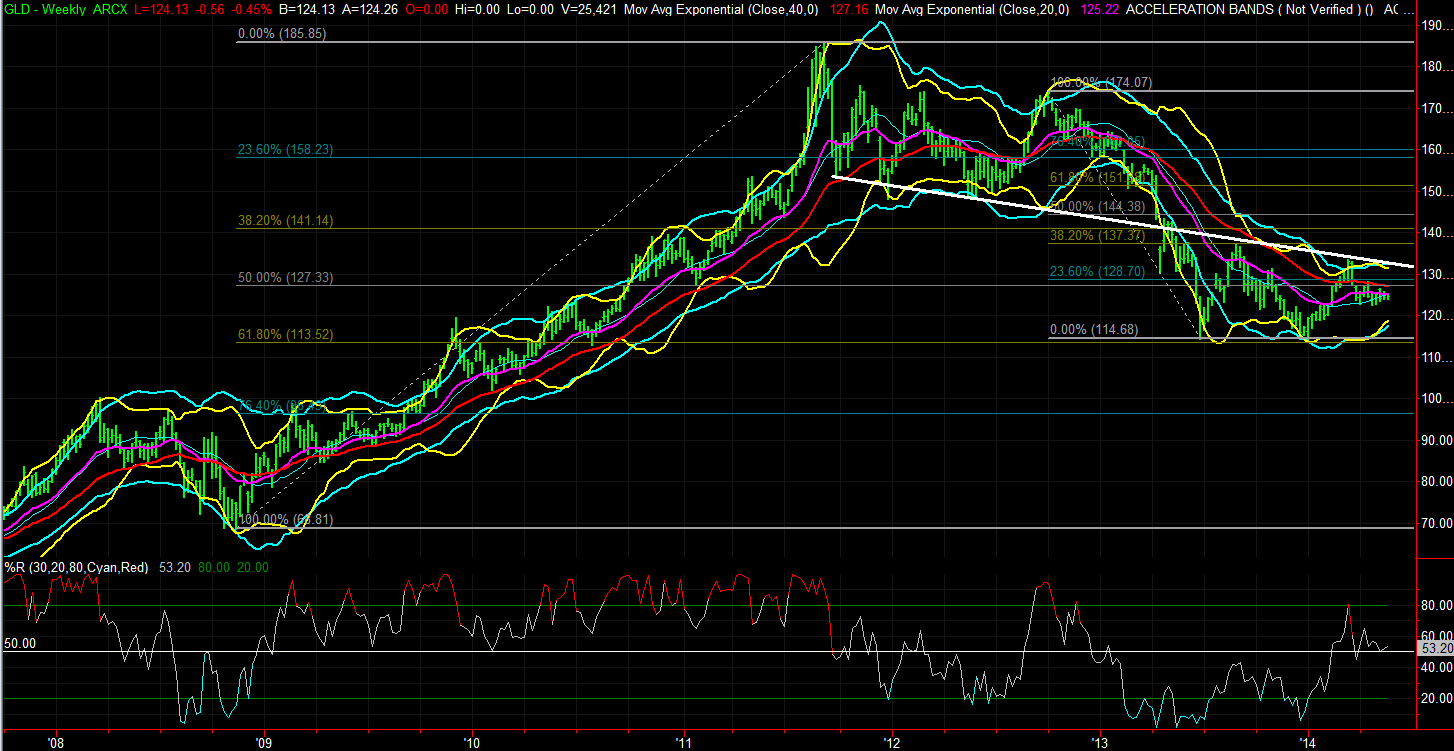

(chart by BigTrends.com, created with TradeStation)