Why China's Weibo (WB) Is Doing Better Than Twitter (TWTR)

The "Twitter of China" is Doing a Heck of a Lot Better Than the United States' Twitter

To say Twitter (TWTR) has been tough to own for the past couple of years would be a considerable understatement. TWTR shares have been more than cut in half since this point in the year in 2014, with no end to the misery in sight.

Some have suggested it's not so much mismanagement, but the concept itself - not enough people care about hearing others' random thoughts 140 characters at a time, which in turn means advertisers are struggling to justify routing dollars to the platform when a much higher-trafficked and more fruitful social networking site called Facebook (FB) is just as easy to tap into. Simultaneously, Twitter is spending too much money relative to the amount of revenue it's producing, and the amount of revenue it's apt to produce in the foreseeable future.

As it turns out, however, it's not the concept of microblogging that's not marketable. It's just how John Dorsey is delivering Twitter's product that's not working. How do we know? Because a Twitter clone is thriving in China.

Weibo Corporation (WB) is China's answer to Twitter, complete with a 140-character limit.... sort of. While only the first 140 characters of a post are visible, other users can expand a longer post to read through a member's complete post. Moreover, the Weibo interface allows for the insertion of video, emoticons, and pictures. Weibo also offers a much wider array of template options, so users can better customize their pages.

The Weibo platform also facilitates discussions by topic, rather than letting/hoping members find or make their own discussions.

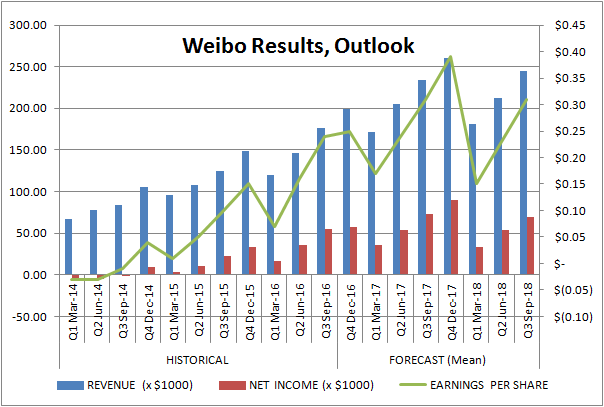

It's an annoying comparison to fans and investors of Twitter, but Weibo is more like Facebook than Twitter is, and that "stickiness" shines through in the numbers. On Monday evening of this week, the company reported revenues of $176.9 million, up 42% year-over-year. Not only did that top the company's guidance of between $168 million and $173 million, analysts were only calling a top line of $173.1 million. Earnings-wise, the profit of 24 cents per share handily topped the year-ago figure of 10 cents per share, topping analyst estimates of 20 cents. The number of monthly active users grew 34% to 297 million.

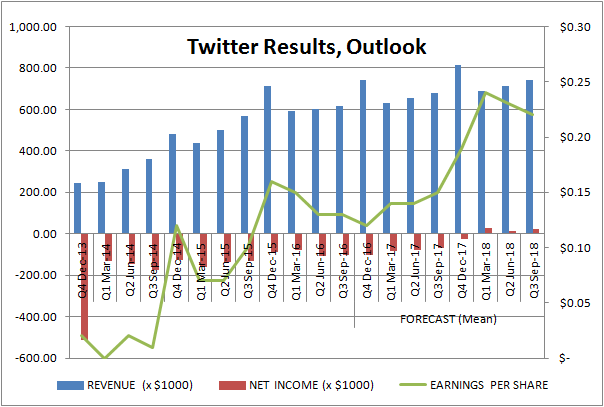

For comparison, for its most recently-reported quarter, Twitter grew its monthly active users by a pace of only 3%, to 317 million. Revenue was only up 8%. And, it's still booking GAAP losses... losses that aren't small.

The most telling part of the story, however, isn't last quarter's disparate numbers. The crux of the story is that this disparity has been persistent or several quarters now. Weibo is soaring, yet Twitter is struggling just to stay afloat after paying all its bills. The charts of each company's historical results paint a shockingly different picture for two otherwise-similar companies. [Twitter's per-share earnings figures are non-GAAP; it's still booking per-share losses on a GAAP basis.]

Analysts do think Twitter is going to wiggle its way into a GAAP profit by 2018, though in light of its history thus far, that may be wishful thinking.

As for the "why," aside from the better engagement Weibo offers its users, a cultural aspect may also be driving Weibo's outsized growth.

As much as western cultures value smartphones as a centerpiece of daily life, in China, consumers are even more glued to their phones. It's not just social networking usage though. They're more apt to use their phones to perform all sorts of tasks, making them a true virtual assistant. Still, the social networking aspect of cell phones are a major draw, and Weibo's mobile-friendly platform lends itself to become the easy, go-to social networking tool for the market.

Still, China's smartphone users are more like western users than not.

Point being, it's not the concept of microblogging that's the problem. It's Twitter. Weibo is doing just fine with the very same business.