What Sectors & Companies Have The Most Brexit Exposure?

Where the S&P 500 faces Brexit exposure

by John Butters

The United Kingdom is a major focus for the market after the Brexit vote. There are concerns in the market about the potential negative impact on the United Kingdom’s economy. Given these concerns, how much revenue exposure does the S&P 500 have to the United Kingdom? Which sectors and companies in the index have the highest revenue exposure to the UK?

According to FactSet Market Aggregates and FactSet Geographic Revenue Exposure data (based on the most recently reported fiscal year data for each company in the index), the aggregate revenue exposure of the S&P 500 (SPX) (SPY) to the United Kingdom (EWU) is 2.9%. This is the third highest country-level revenue exposure for the index, trailing only the United States (68.8%) and China (4.9%) (FXI).

At the sector level, the Energy (6.4%) (XLE), Information Technology (4.0%) (XLK), and Materials (3.7%) (XLB) sectors have the highest revenue exposures to the United Kingdom.

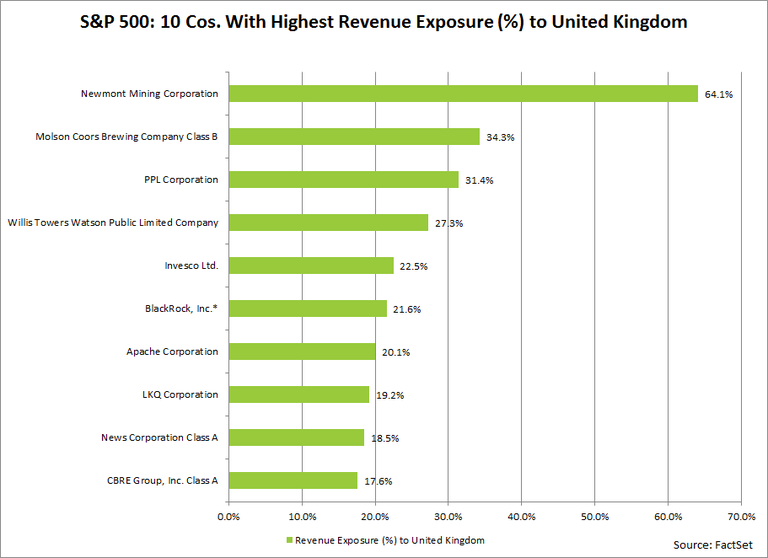

At the company level, 30 companies in the S&P 500 have revenue exposure of more than 10% to the United Kingdom, led by Newmont Mining (64%), Molson Coors Brewing (34%), and PPL Corporation (31%).

Prices Increase for Companies with High UK Revenue Exposure

It is interesting to note that since February 20 (the date the UK announced the June 23 timeline for the EU vote), the companies in the S&P 500 with more revenue exposure to the UK have seen higher average and median price increases relative to the index as a whole.

For the entire S&P 500 index, the average price change for a stock from February 20 through June 16 was +11.3%. For the companies in the index with more than 10% revenue exposure to the United Kingdom, the average price change for a stock over this period was +16.7%. For the entire S&P 500 index, the median price change for a stock from February 20 through June 16 was +9.6%. For the companies in the index with more than 10% revenue exposure to the United Kingdom, the median price change for a stock over this period was +14.3%.

Courtesy of factset.com