Bitcoin Jumps Again, And This Time May Be A Little Bit Different

Say what you want about its risks and arbitrary nature (and inherent structural/fiscal problems), but nobody can deny the value of Bitcoin -- the popular cryptocurrency -- has soared over the course of the past month, putting the digital currency back into the spotlight thanks to a resurgence of interest mainly from China.

Since September 20th, the value of one Bitcoin has soared from $227 to a peak of $455 as of Tuesday of this week, with the bulk of that advance materializing in just the past two weeks. Even with Wednesday's slow-down, the value of Bitcoin is up 86% since the end of September. Similarly, the Bitcoin Investment Trust (GBTC) is up 92% in just the past two weeks.

The prod for the rally after a prolonged period of tepid prices and lackluster movement from Bitcoin (up or down) isn’t precisely clear, but most plausibly it was spurred by a convergence of several factors at the right time in the right way.

One of those biggest factors is renewed interest from China, which may or may not have stemmed from rumors that the cryptocurrency may be used as a means of funding the participation in Macau’s gambling junkets (perhaps illegally). Another possible reason for the rally could be a recent report from the UK’s Magister Advisors suggesting Bitcoin could be a major reserve currency within 15 years. Still another explanation is the fact that the digital currency was further legitimized when bank USAA partnered up with Bitcoin wallet provider Coinbase to allow its banking customers to handle their digital money just like they manage their actual currency. One more possible reason the digital currency has been so hot of late: In September, the Futures Trading Commission officially named Bitcoin a commodity.

Mostly though, experts and observers aren’t quite sure why the cryptocurrency has nearly doubled in just a few days, other than explaining that demand has greatly outstripped the supply for more than just a few days. It’s entirely possible Bitcoin is going higher simply because it’s going higher.

Whatever the reason, it should be noted that no major Bitcoin rally has lasted very long; many have been significantly wiped out, giving back all their hard-fought gains, and then some.

Still, patterns were meant to be shattered, and if the boom-and-bust cycle for Bitcoin is due to be disrupted, this may be the best shot yet of doing so.

Of course, there are large risks inherent in Bitcoin -- such as it is largely unregulated (generally no way to short or buy puts, for example) and often illiquid (particularly if there is a large amount of redemptions for cash), often used for unsavory black and grey market purposes, not user friendly to the average user, a breeding ground for scams and hackers ... and some say built upon a pyramid type structure with a limited money supply and huge early adopter advantage.

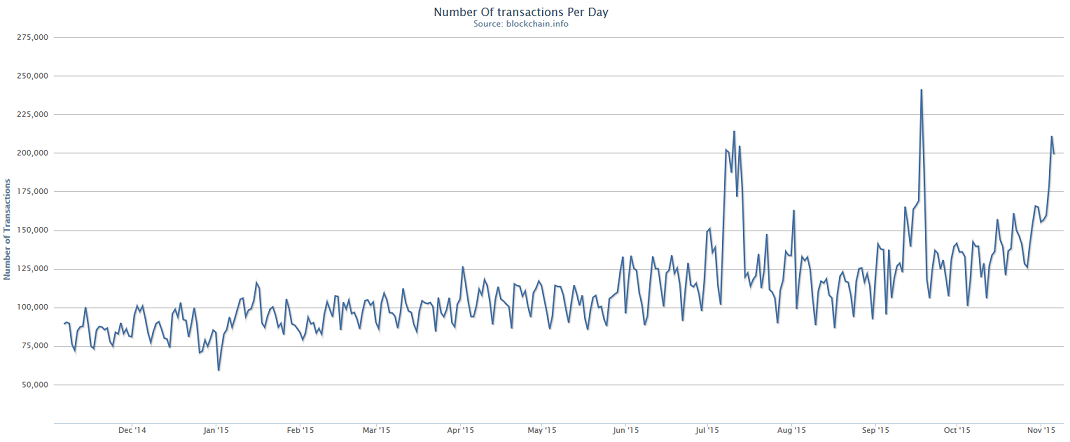

While the total number of Bitcoin transactions has been steadily rising since 2012 when the cryptocurrency was first put into circulation to a meaningful degree, three times since July has the daily number of Bitcoin transactions spiked. One surge can be chalked up to volatility, but three repeated surges suggests the digital currency may finally be taking on a life of its own, leading traders rather than being led by traders.