Record VIX Bets Keep Surging Amid Wall Street Mixed Signals

- Open interest on VIX call options highest since September 2014

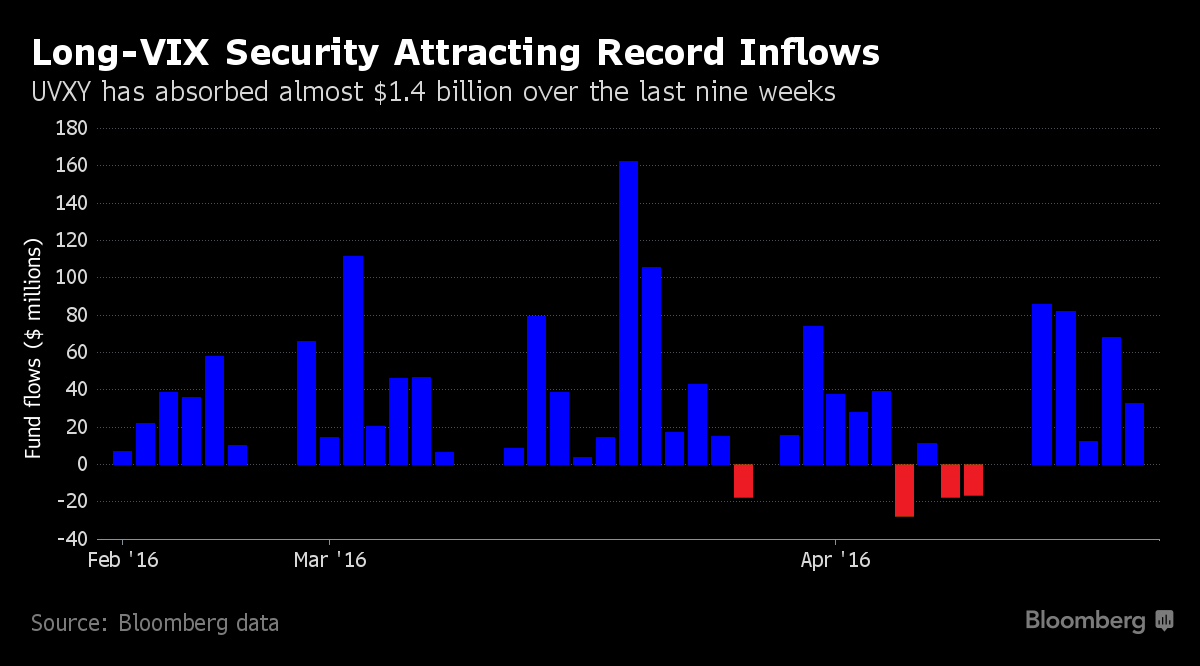

- Long-VIX securities have absorbed $3.2 billion over nine weeks

One thing’s certain about the market for equity volatility -- it’s jumping. Why that’s happening is a source of debate on Wall Street.

Going long market turbulence has surged in popularity in the last nine weeks, with investors sending an unprecedented $3.2 billion into securities that reap gains from wider price swings. That pushed shares outstanding on exchange-traded notes tied to the Chicago Board Options Exchange Volatility Index to a record and has wagers on volatility near the highest level since 2014.

All that as U.S. stocks rallied 14 percent and the CBOE Volatility Index (VIX) (VXX) plunged.

Derivatives strategists from Deutsche Bank AG attribute the positioning to investors who still doubt the staying power of a stock market runup that’s added more than $2.5 trillion to share values. To Barclays Plc, the opposite is true: the increase is equity bullish, with investors simply protecting their expanding wagers on stocks.

“We’re starting to see conflicting signals,” said Ramon Verastegui, head of flow strategy and solutions in the Americas at Societe Generale SA. “Both hedge funds and retail got long” volatility, he said. “The ETN players have been buying even more, and we’ve seen very large creations, but hedge funds have been cutting positions.”

For Maneesh Deshpande, head of equity derivatives strategies at Barclays, the shift in sentiment indicates that at least some investors are no longer making the long-VIX trade out of fear the equity rally is running out of steam.

After nine weeks of bullish positioning on the VIX, hedge funds and large speculators had a change of heart in the week ended March 22, data from the Commodity Futures Trading Commission show. Their VIX bets have gotten increasingly negative over the last three weeks, the data show. Managers are now just trying to protect gains realized as the S&P 500 (SPX) (SPY) approaches an all-time high, Deshpande said.

“You have to keep in mind that when open interest on VIX calls jumps or VIX ETP inflows pick up, that doesn’t necessarily indicate nervousness,” he said. “To me it indicates bullishness right now, with investors buying options, as they have exposure to risky assets. You go to cash when you’re very bearish, and then you don’t need to buy the protection.”

The VIX has traded below 20 for 37 straight days, the longest such streak in 13 months. The gauge slid 2.2 percent to 13.64 at 9:48 a.m. in New York.

To Rocky Fishman of Deutsche Bank, the recent lack of equity volatility has convinced some investors that price swings may return. With the volatility on the VIX itself likely to remain high, he recommends investors buy Standard & Poor’s 500 Index put spreads -- a strategy that involves purchasing and selling bearish contracts on the measure simultaneously.

“Investors don’t believe this low-volatility environment will continue,” said Fishman, an equity derivatives strategist at Deutsche Bank. “Seeing how low the VIX is, it’s an opportunity to buy inexpensive S&P 500 options.”

The CBOE VVIX Index has climbed 5 percent this quarter, and its average this year is about 8 percent higher than its historical average, data going back to 2006 show.

There may be another reason that call activity has continued to swell amid the stock rally, according to Deshpande. Credit investors may be looking to protect recent gains delivered by a 29 percent contraction in the credit spread for investment-grade bonds since Feb. 11. That’s pushed more investors into fixed income trading.

“Credit spreads have rebounded and people are investing in the space again,” Deshpande said. “So they need hedging.”

Courtesy of bloomberg.com