Various Analysis Indicates 2/3 Chance Of Market Rise In 2017

There's a 65% chance that the U.S. stock market will rise in 2017

Those are the historical odds, which are remarkably impervious to fundamental conditions

by Mark Hulbert

There’s a 65.5% chance that the U.S. stock market will rise in 2017. If you’re like most investors, that’s welcome news.

Given the advanced age of the economic expansion, an overvalued stock market by virtually any measure and the uncertainty surrounding a new president, a two-out-of-three chance of turning a profit seems almost too good to be true.

Still, before you make too much of those odds, know that they would not be meaningfully better or worse if conditions were different. That’s because the stock market looks forward, not backward. Current conditions are already reflected in stock prices. The stock market trades higher or lower at any given time to settle on whatever level that results in it being higher a year later two out of three times (on average).

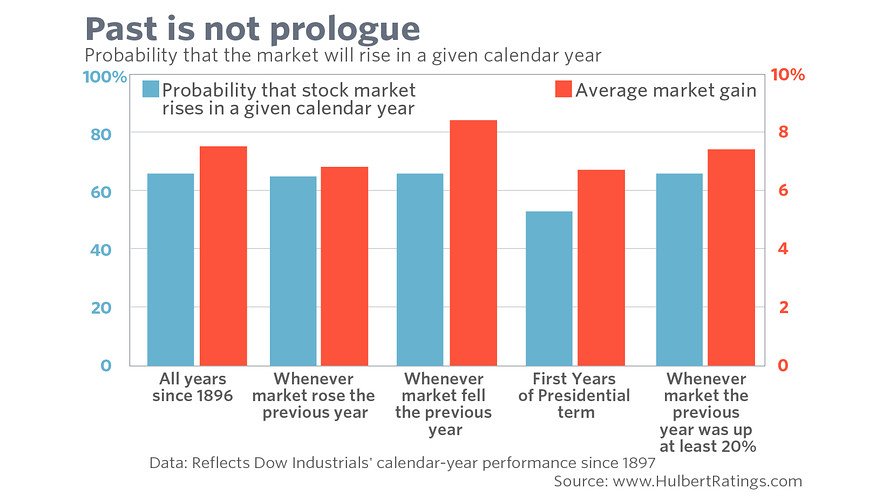

Over the 119 calendar years since the Dow Jones Industrial Average was created in the late 1800s, for example, it has risen 78 times, or, 65.6% of the time. Whenever the market rose during a given year, its odds of rising the next year were a virtually identical 65.4%. Following years in which the market fell, in contrast, its odds of rising the next year were 65.9%. (See the accompanying chart.)

Many believers in market momentum find those stats surprising, since they expect a gain in one year to translate into above-average odds of rising the next year. Contrarians are also surprised, since they expect a loss in a given year to create above-average odds of rising the next.

But neither of those expectations is borne out by the data.

Particularly revealing in this regard are the odds of a rising market following years in which the market rose by more than 20%. If year-to-year momentum were to show up, those would be the years in which it should show up the strongest. Yet the market’s odds of rising following greater-than-20% gains are an almost-identical 65.6%.

To be sure, there isn’t some law of the universe that mandates that the market rises in precisely two out of three calendar years. Those historical probabilities reflect the stock market’s risk, its volatility and investors’ risk-aversion. So long as those factors don’t change, we shouldn’t expect any change in the stock market’s probabilities of going up in any given year.

You will notice from the chart another set of columns focused on whether we’re in the first year of a presidential term. On first blush, it looks like there are meaningfully lower odds of a higher market during such years. But it turns out that this difference is not significant at the 95% confidence level that statisticians typically use to determine if a pattern is genuine.

The same is true for the price-to-earnings (P/E) ratio. Take the 20% of calendar years since the late 1800s in which the P/E was the highest. (We currently are in this most overvalued quintile, by the way.) If P/E valuations had a significant impact on next-year returns, they should most definitely translate into lower odds of subsequent-year gains.

Yet, in the years following the highest P/Es, the market rose 66.7% of the time — two out of three, in other words.

The Cyclically Adjusted P/E ratio (CAPE or Shiller P/E) performed only marginally better: The stock market rose 58.3% of the years following CAPE readings in the highest quintile. But, once again, that difference is not significant at the statisticians’ 95% confidence level.

Those remarkably similar odds in all situations don’t mean that valuations have no role to play. It’s just that valuations have their biggest impact over many years. Over a given 12-month period, they exert only a very weak gravitational pull on the market.

Ben Inker, co-head of the asset-allocation team at Boston-based money management firm GMO, draws an analogy to a leaf in a hurricane: “You have no idea where the leaf will be a minute or an hour from now. But eventually gravity will win out and it will land on the ground.”

Courtesy of marketwatch.com