It was already on the defensive, but with today's blow, the U.S. dollar is officially in trouble… perhaps even en route to a collapse. In response to the failure of President Trump's effort/bill to repeal and replace Obamacare (though one has little to do with the other), traders have sent the U.S. Dollar Index down enough that it's broken below a key low of 99.24 made in early February, and below the 200-day moving average line. It's the first time since October of last year the dollar has been below its 200-day average. With a lower high already in place, this breakdown is a significant red flag.

The demise of the greenback — despite the rhetoric — is the typical one. Brown Brothers Harriman's currency strategy chief Marc Chandler explained early on Monday morning:

"Although there are conflicting impulses, interest rate differentials continue to appear to be the single most important factor in considering currency movement presently. The question of the dollar is in good measure a question of the direction of interest rates."

Still, to the extent a replacement for the country's current healthcare system was part of a "package-deal" Trump agenda, the failure of this piece of it calls into question all of it, and it was the package that ultimately fueled not only a similar market rally, but strong rally for the dollar since his election on expectations that he would light a fire under the economy and force interest rates higher. So far, the Fed has no reason to be any more aggressive with its rate hike plans than it was planning to be before he was elected. The market is simply making the correction of its errant move in rates, and the greenback as well.

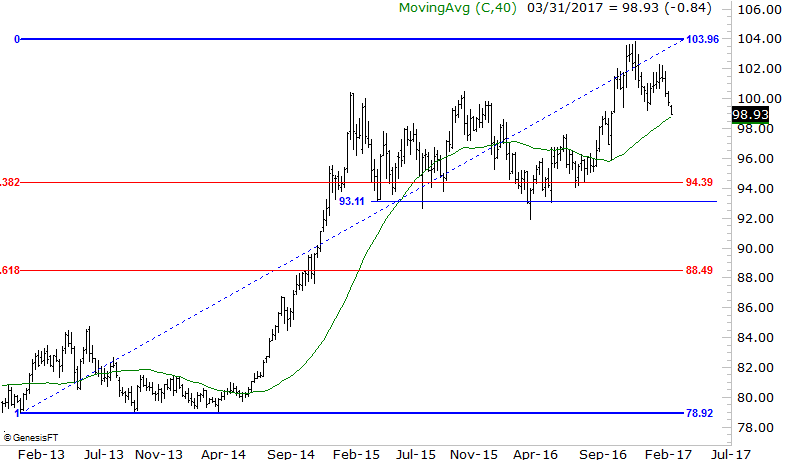

All the same, today's plunge is particularly alarming, in that it does a great deal of technical damage. Potential downside targets include a floor at 93.11, where the U.S. Dollar Index found support for the better part of 2015 and early 2016, or 94.4, where a major Fibonacci line awaits. A move to either level would have a noticeable impact on all dollar-sensitive stocks and markets like gold and oil…. a bullish impact. It would also prove positive on U.S. companies that rely heavily on sales of goods to overseas customers.

Caution is advised before drawing any firm conclusions, however. As easily as this swing developed, new sentiment could materialize and undercut the bearish effort. The rhetoric is doing far more than the fundamentals are at this point.