Trump Win Brings Record Inflows Into Financial ETFs

Financial ETF Sees Record Inflows After Trump Win

"The market sees the banking industry as a dog off its leash"

by Luke Kawa

President-Elect Donald Trump has greatly enhanced the outlook for U.S. bank profitability, by laying the foundation for a steeper yield curve and financial deregulation.

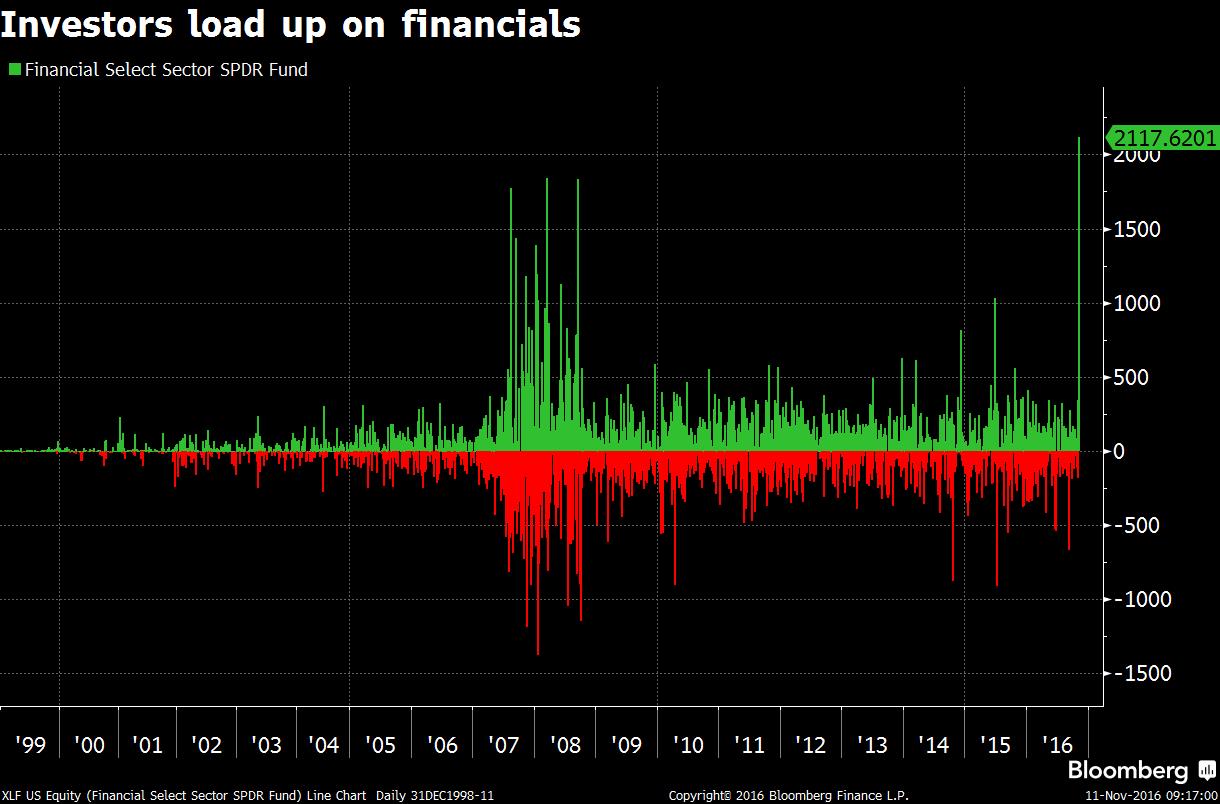

Recognizing this, investors are voting with their feet, with record one-day inflows of more than $2.1 billion into the Financial Select Sector exchange traded fund (XLF) on Thursday.

"Financial ETFs are taking off like a rocket after Trump's win, getting a double boost from deregulation and rising rates," writes Eric Balchunas, ETF analyst at Bloomberg Intelligence. XLF closed at $21.61 on Thursday, up 8.1 percent since the election and its best two-session showing since 2009.

Trump's official transition website indicated that the "Financial Services Policy Implementation team will be working to dismantle the Dodd-Frank Act," which was signed into law by President Barack Obama in 2010 with a goal to rein in big banks.

"Does a dog move faster when it's on a leash or off the leash?" said Neil Dutta, head of U.S. economics at Renaissance Macro Research. "The market sees the banking industry as a dog off its leash."

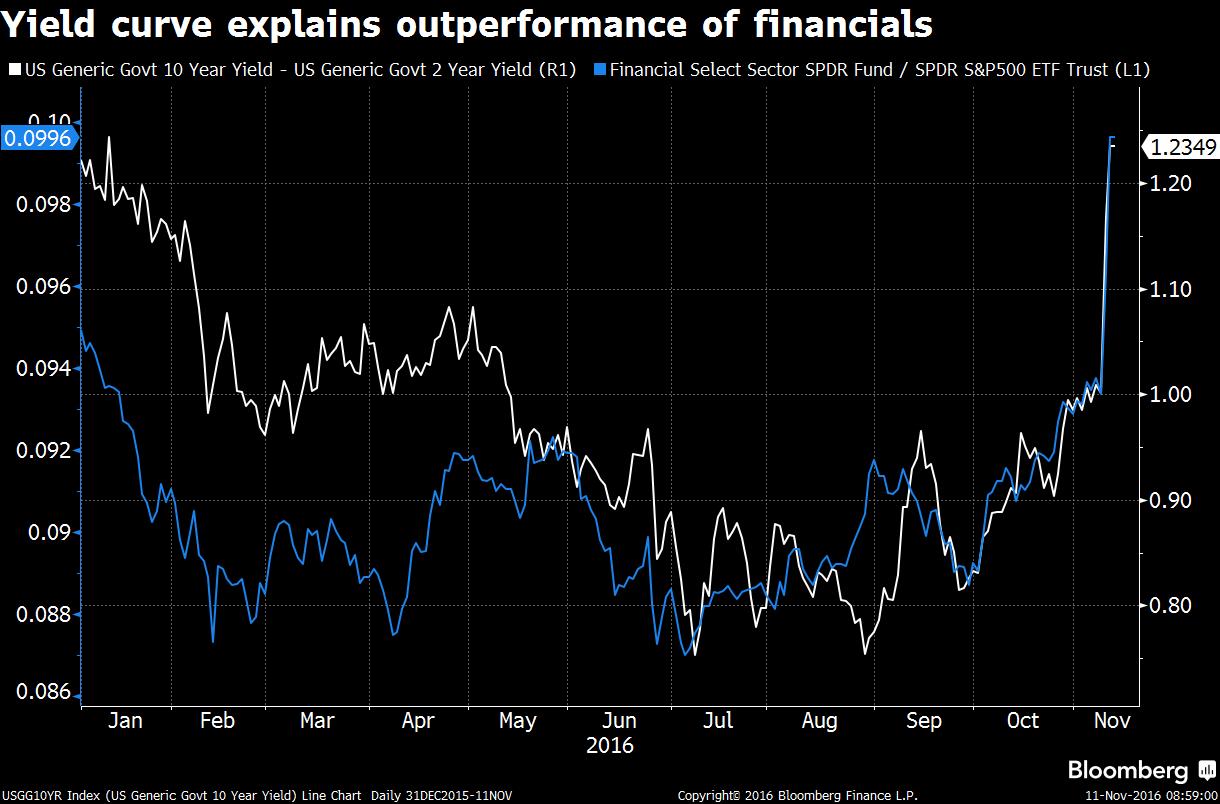

In addition, the steepening of the Treasury yield curve — with longer-term yields rising more than those for short-term debt — helps explain why financials have fared better than the S&P 500 Index at large.

Rising market-based measures of inflation expectations, in light of Trump's inflationary proposals, have fostered this steepening of the yield curve.

As banks are engaged in the business of maturity transformation, the widening spread between yields on short and longer term debt bodes well for net interest margins and profitability.

Courtesy of bloomberg.com