Treasury Bond Yields & The Dollar At Crucial Levels

U.S. Bond Yields, Interest Rates Facing a Currency Headwind

Most market-data junkies know that bonds have been on the rise this year while rates have forced on only fallen. What may not be fully appreciated, however, is just how close both are two game-changing levels. With just a little more improvement in bond prices and/or a little more weakness in yields, both could move into technical territory where the bigger trends currently underway heat up significantly.

The chart of long-term treasuries - using the SPDR Lehman Long Term Treasury ETF (TLO) as our proxy - and the 30-year Treasury Yield Index (TYX) below tell the story. Both have been squeezed into a combination of a converging wedge in a pennant shape since early last year. In the meantime, a horizontal ceiling for treasuries as well as a horizontal floor for yields have materialized. In both cases, the instruments in question are knocking on the door of a major break. For treasuries, it's a bullish break above the 76.5 mark. For 30-year yields, it's a break below 2.49%. Any movement beyond those marks (in light of the fact that in each case the momentum is already pushing things that direction) could lead to a surprisingly strong consequences as a whole slew of traders are forced into making a decision.

At least a big part of the prod for this newfound movement is the recent breakdown of the U.S. dollar.

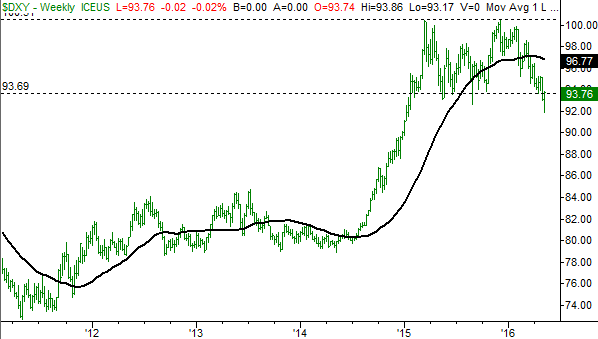

As our chart of the U.S. Dollar Index (DXY) (UUP) below indicates, after being range-bound in 2015, the index just last week broke under a pivotal floor at 93.7. Since then the index has made a modest attempt to crawl back inside the trading range, but so far we can chalk of the bulk of that bounce effort up to nothing more than a little trading volatility. The bigger trend is still bearish, and we got no specific reason to think the modest bounceback thus far is a threat to that trend.

These two charts go hand-in-hand primarily because interest rates for a country and that country's currency tend to move in tandem - although not always.

They were uncoupled in 2012 - and really, well before then - when the market as a whole was certain interest rates were going to soar in response to unrelenting inflation... inflation that never actually materialized. The U.S. dollar and yields moved in the opposite direction again in 2014 primarily because traders were then snatching up the dollar in anticipation of rising interest rates... which again, never happened. Now convinced there's little purpose in trying to speculate what the Fed may or may not do (since the Federal Reserve itself doesn't even know itself what it's going to do tomorrow let alone months from now) bond yields and the U.S. dollar are finally back in the same boat.

Whatever the case, with the U.S. dollar in a downtrend that's arguably long overdue and well rationalized, it would be surprising if yields didn't peel back accordingly even if there's not a great deal of room for yields to keep sliding lower. That is to say, the dollar itself may fall much further than treasury yields do. The two should move in the same general though.