The Real NYSE Advance/Decline Line Is Not As Healthy As It Appears

The NYSE advance/decline line is lying to you

by Adam D. Koos

There has been a lot of talk about the NYSE advance/decline line hitting new highs and how this indicator is suggesting the resurgence of a secular bull market today. What if I shared the fact that this NYSE indicator lies to you? It's not an intentional, malicious lie, but what if you discovered that the NYSE was riddled with non-stock investments that cloud the index and, thus, deform such indicators as the advance/decline line?

The NYSE has evolved over the years to the point where, like a son who's gone to live on an island only to return a year later without cutting his hair or shaving even once, you might not even recognize it. Long gone are the days of the New York Stock Exchange trading only stocks. In fact, when you take a dive into the guts of the exchange, what you'd find might surprise you.

Hidden behind the age-old acronym "NYSE" is a plethora of non-stock investments. Sure, you can find plenty of stocks you're used to seeing on the S&P 500 (SPX) (SPY), but what you'd also find is an abundance of preferred issues, REITs, and closed-end fixed income funds. An extraordinary 52% of the NYSE consists of non-stock investments. Don't you think this might affect the results when observing the current state of the NYSE advance/decline line?

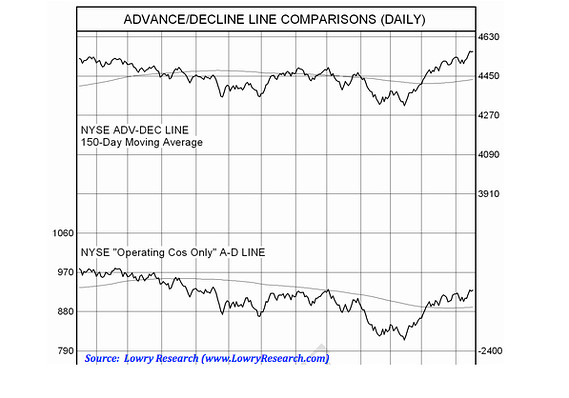

In order to get a real look at the number of advancing stocks vs. those that are declining, you have to know where to look. Below are two very different charts. The first is the good old NYSE advance/decline line that you may have seen on television recently, accompanied by a lineup of reporters and analysts touting the start of the next bull run. The chart just below it is the one you want to pay close attention to. It exhibits the NYSE advance/decline line of operating companies, or in other words, only individual stocks.

Notice the stark difference between the two charts. The first chart, which includes interest-rate-sensitive "safer" investments above parades a new high. Conversely, the second chart, which removes the rose-colored glasses from our field of vision, shows us the real truth — that individual stocks advancing vs. those declining is a metric that is nowhere close to a new high. Rather, it's struggling to break north of overhead resistance, which resides back in November.

There are some investors and traders who are already aware of the information above. Whether you're a professional "in the know" or someone who just learned something new today, the articles published on a new high in the NYSE advance/decline line is behavioral finance at its best.

Certain heuristics lead to a number of psychological errors when investing one's hard-earned savings. We all want to grow our portfolios as fast and as safely as possible, but we're all human. Amateurs and professionals alike suffer from different types of hindsight or confirmation errors. They subconsciously think that, because the market has risen for more than seven years, that it should continue rising. So a story on a new high in the NYSE advance/decline line is exactly what they want to hear, which is an error called Cognitive Consonance.

Conversely, many reading this column may get upset, since the information I've just shared may not confirm their hope for near-term higher stock market prices. As a result, these readers may feel compelled to underweight or completely disregard the information, since it doesn't support their opinion (something called Cognitive Dissonance).

The stock market is a huge, psychological voting mechanism, where all the “votes” are cast in the form of stock trades. Rather than trying to predict the future of market movements, it is advisable to observe what the market is showing you and then adapt accordingly. Today, the market is exhibiting instability in the form of a fragile bear-market rally, combined with significant overhead resistance, all while entering the seasonally weak six months of the year.

Conditions such as those being observed in the current market landscape are ones that deserve both attention and caution. As Warren Buffett once said, "The best way to make a dollar is to not lose a dollar."

Courtesy of marketwatch.com