- Big banks (KRE) (XLF) add $2 billion for energy loan losses in 1Q

- Oil woes at JPMorgan, Citigroup, Bank of America, Wells Fargo

This is what it looks like on the down side of the biggest oil boom in U.S. history.

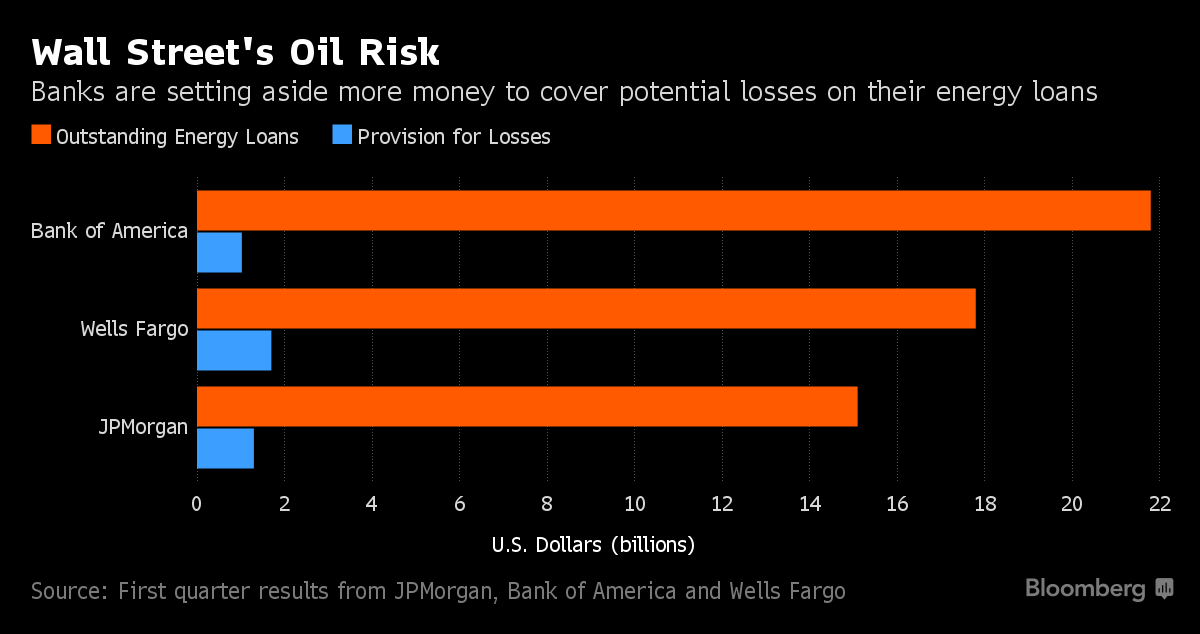

JPMorgan Chase & Co (JPM)., Wells Fargo & Co. (WFC), Bank of America Corp. (BAC) and Citigroup Inc. (C), with a combined $190 billion in energy loan exposure, all announced this week that they’re setting aside more money to cover losses. Though energy (XLE) is a relatively small share of their assets, it’s been a big issue on analyst calls this week.

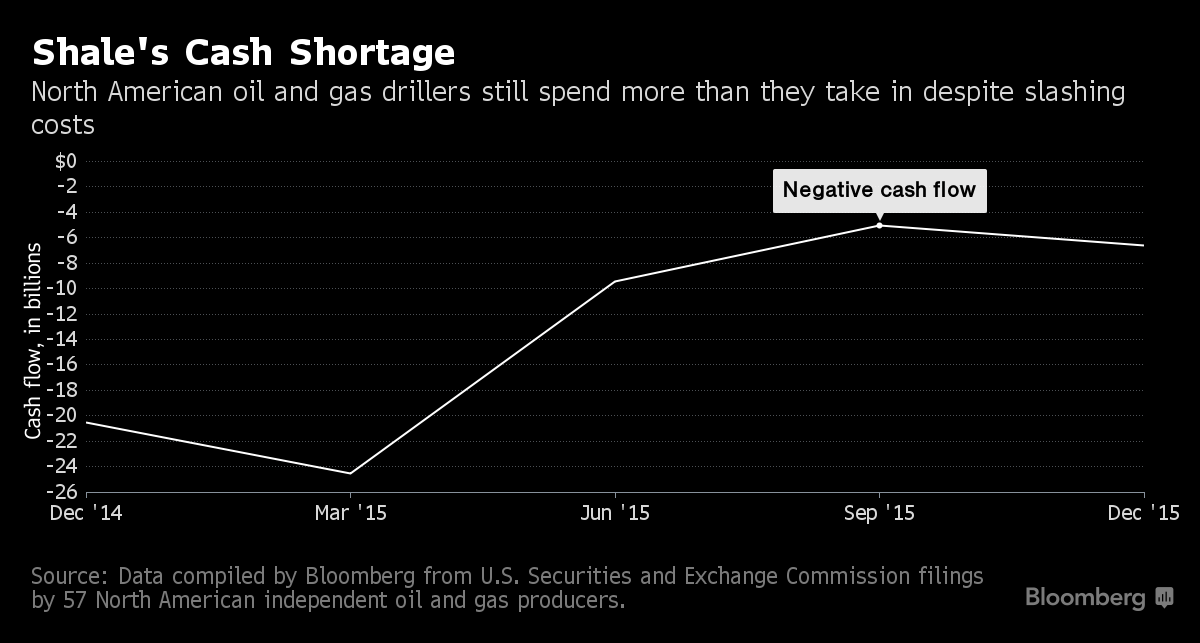

The record-breaking surge in U.S. oil production wouldn’t have been possible without a tremendous amount of debt. Many independent drillers, the small producers that drove the shale boom, outspent cash flow even when oil was $100 a barrel, and made up the difference with bank-loans and high-yield bonds. Put simply: No banks, no boom.

With oil down to around $40 a barrel, many energy companies are struggling to stay afloat. The two hardest-hit sectors have been upstream, which includes companies that produce oil and natural gas, and oilfield services, the firms that do much of the actual drilling. Since the start of 2015, 51 North American oilfield service companies (OIH) have gone bankrupt as of March 23, while 59 oil and gas producers (XLP) have filed as of April 3, according to law firm Haynes & Boone LLP. Together they owe almost $27 billion.

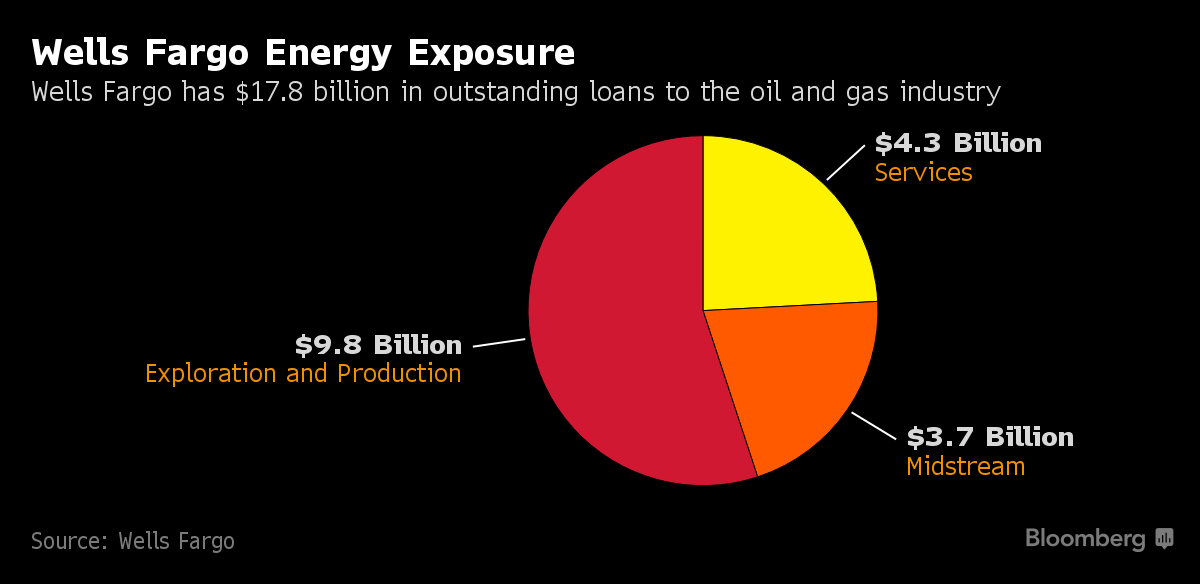

That means trouble for lenders. Of the four big banks to report results this week, Wells Fargo has the biggest reported exposure to those sub-sectors, at about $14 billion, or 79 percent of their energy loans outstanding. The bank boosted loan-loss provisions for oil and gas to about $1.7 billion and reported net-charge offs of $204 million. And it doesn’t look like things are getting better: oil producer Energy XXI Ltd. filed for bankruptcy Thursday. Wells Fargo was the lead lender on its credit line, company records show.

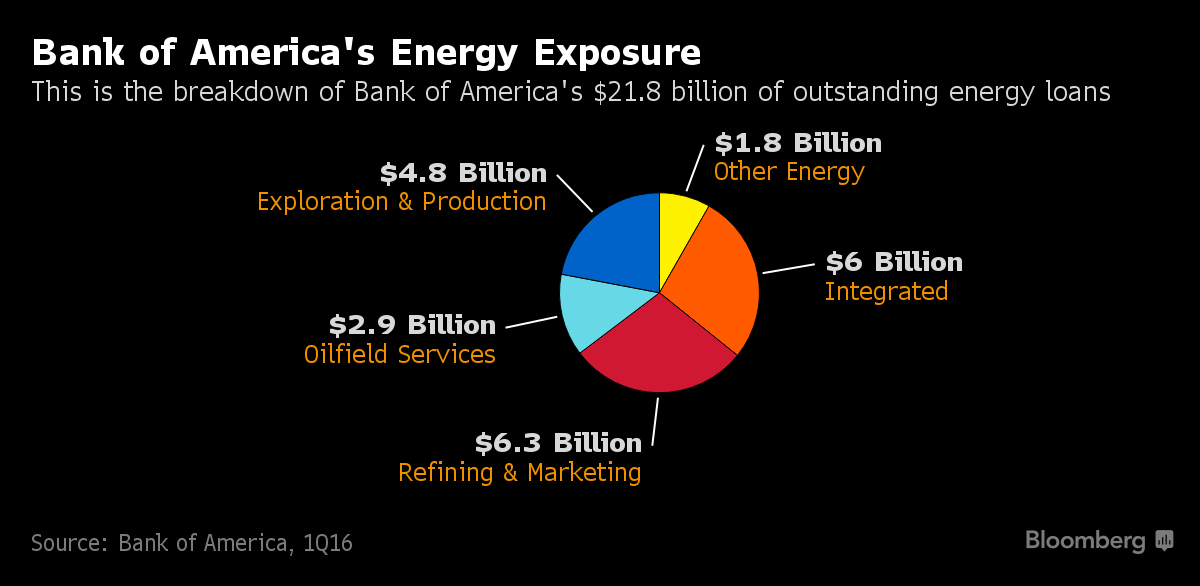

By contrast, Bank of America has about $7.7 billion outstanding to the upstream and oil and gas services sectors out of $21.8 billion.

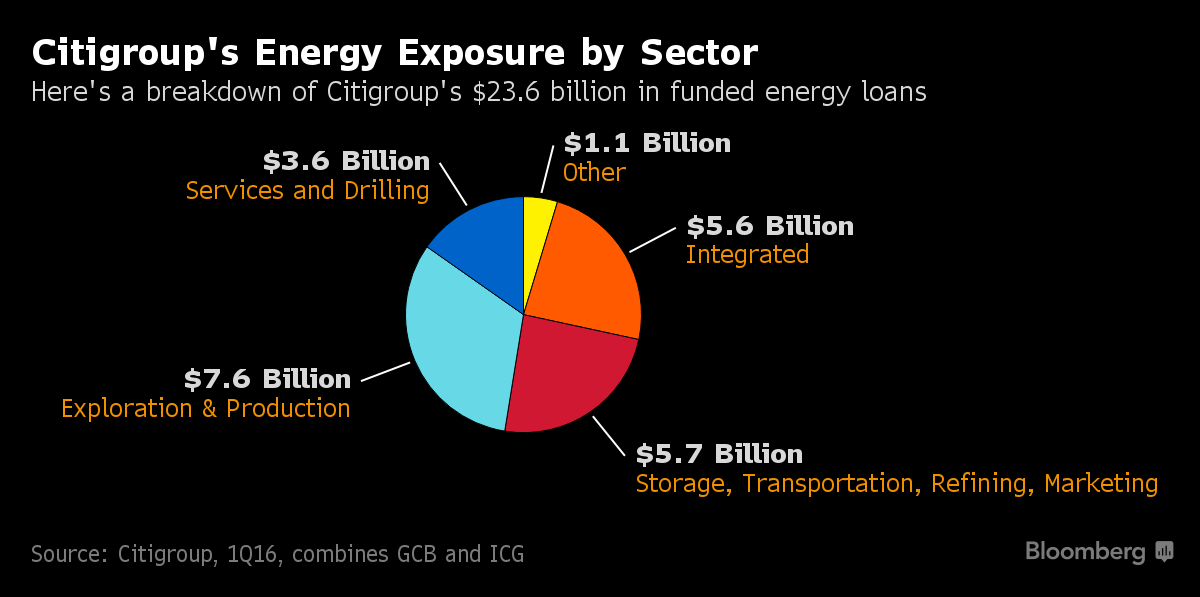

Citigroup’s looked like this at the end of 2015:

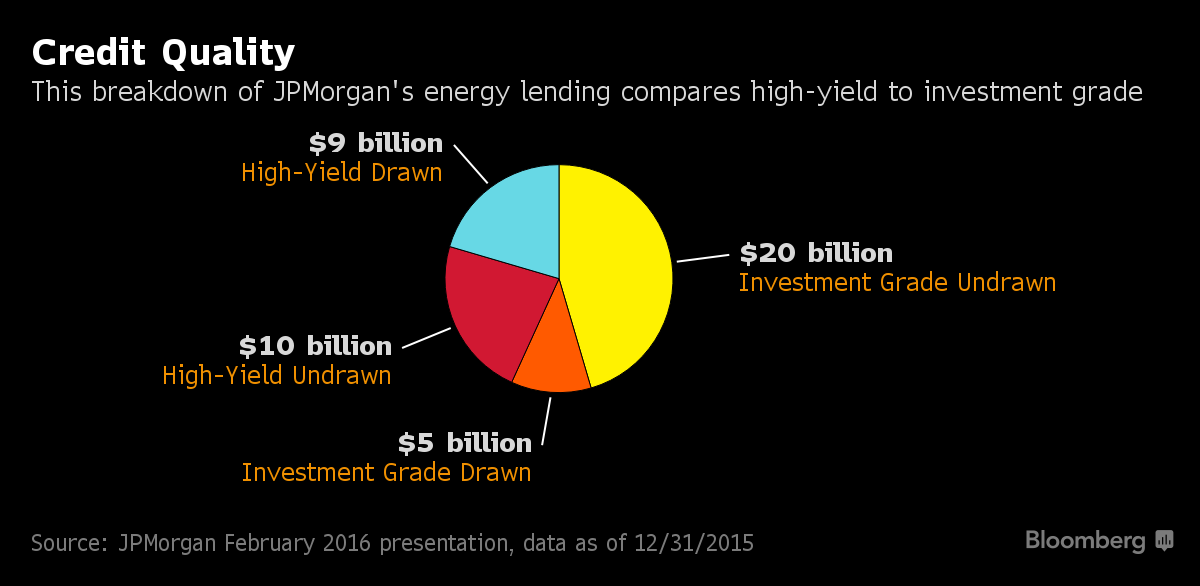

JPMorgan hasn’t provided sector-by-sector data yet for the first quarter. At the end of 2015, the bank said about 52 percent of its $44 billion in oil and gas loans and commitments was to the upstream and oil and gas services sectors. Here’s a breakdown of JPMorgan’s energy loans comparing high-yield to investment-grade. It illustrates a trend that’s true across all of the banks: junk-rated borrowers use more of their credit. That’s been an issue this year as troubled energy companies draw down their credit lines as they approach default.

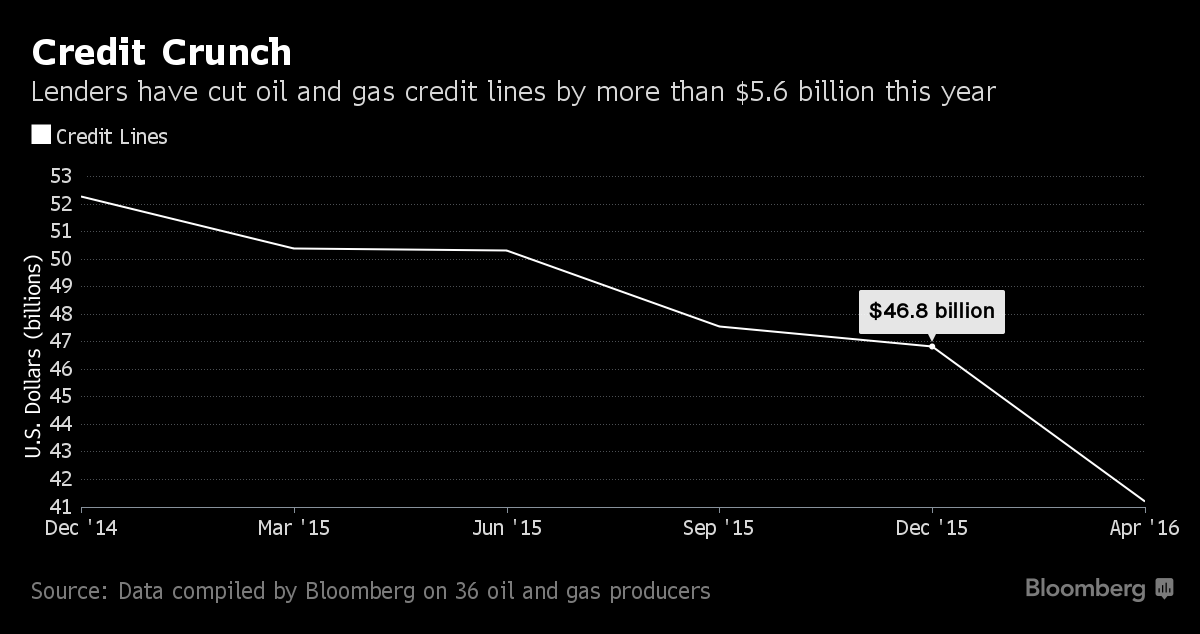

To limit their risk, banks have been cutting credit lines. They’re in the middle of their semi-annual review of oil and gas reserve values, which determines how big the credit lines backed by those assets can be. Last year’s reevaluations were benign. Not anymore. Regulators and investors are pushing banks to limit their exposure to the industry. Since the start of the year, lenders have yanked $5.6 billion in credit from 36 oil and gas companies, according to data compiled by Bloomberg.

Courtesy of bloomberg.com