This is Far More Important for an Oil Rebound Than OPEC's Output Cut

Good news for energy companies and oil bulls this week -- OPEC ended up deciding to curb its crude output as a means of propping up oil prices (USO). Those higher prices should prove beneficial to all oil producers, there and here. Crude prices jumped sharply on that news from Wednesday, and have yet to look back.

What if, however, strong oil prices had less to do with its supply, and more to do with something unrelated to its supply/demand dynamic?

As it turns out, as bullish as Wednesday's news was treated, the price of oil does indeed have less to do with how much oil the world's providers are producing, and more to do with the value of the U.S. dollar... the currency oil is priced with. With that as the backdrop, OPEC's production cut can't save the energy industry should the dollar continue to rise. On the flipside, a decent drop in the value of the greenback could save oil even if OPEC doesn't exactly follow-through on its plans to curb its output (a very real possibility, by the way, if history is any indication).

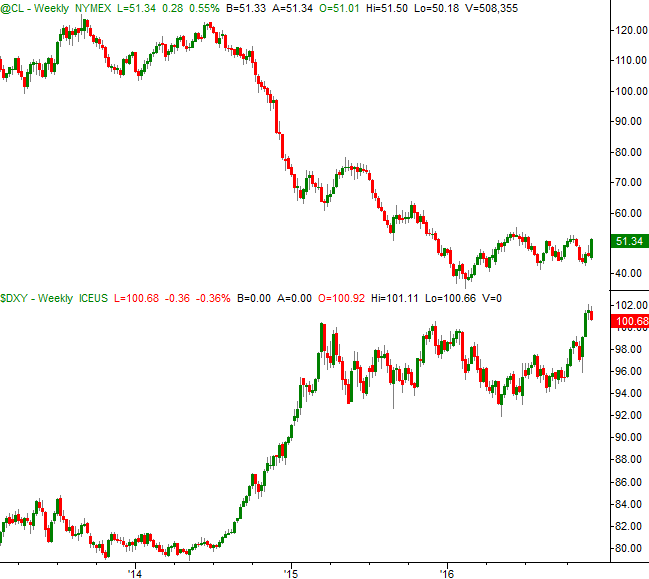

The chart below tells the tale, comparing the demise of crude prices since 2014 with the rise of the U.S. Dollar Index. It's not a perfect correlation, but a strong one.

The relationship has somewhat broken down since last month, with the U.S. dollar rising, and crude oil not falling. By that same token, while the U.S. Dollar Index has peeled back a bit from multi-year highs this week, crude oil prices have downright soared.

Most of that gain was attributed to OPEC's decision to crimp its supply, but the market isn't that naive to think OPEC's small (and unguaranteed) production cut should create this much of a bullish impact on oil prices. This is the market's subconscious way of saying OPEC's nudge will help the bullish work the U.S. dollar is going to do when it pulls back... if it pulls back.

And it certainly looks like it will, at least in the near-term. The U.S. Dollar Index has made a strong reversal pattern over the course of the past two weeks, putting pressure on a major support level of 100.65 as of Friday. It's also decidedly overbought.

To what extent and for how long that pullback will take shape is the key question. There is no answer yet, but "a lot" can't be ruled out as an answer.

The bullish thesis for the greenback is rooted in the bullish argument for U.S. interest rates. Those rates have been rising in anticipation of a rate hike from the Federal Reserve later this month, followed by several more next year. As of the latest look though, only one more rate hike is plausible in the coming year.

Translation: Too many traders overshot with their interest rate expectations, setting up a potential lull in the rate rally. That's going to add to the already-bearish pressure being put on the overbought U.S. Dollar Index, which in turn adds to the bullish pressure already being applied to crude oil prices.

It's an important reality to keep in mind for the near future, as the impact (or lack thereof) of the OPEC decision takes hold.

To that end -- and just for a little perspective -- OPEC's production cut is more bark than bite. The oil cartel is aiming to pare back its output from an average of 33.3 million barrels per day to 32.5 million... a respectable but not enormous 2.4% decrease in output, IF all of OPEC's members abide to the agreed-upon limit. That production crimp becomes even smaller relative to the 96 million barrels of oil produced every day on a global basis. OPEC can't (and won't) do it alone, and even if it could or wouldn't it wouldn't matter that much. If crude oil is going to make a robust recovery, it's going to be because the U.S. dollar peels back... a lot.

The good news is, that contraction or the United States' currency looks like it's in the cards.