The Market's Best Year-End Industries

It's not exactly a secret the market tends to do well in the last quarter of the year. On average, the S&P 500 (SPX) (SPY) gains 3.7% between the end of September and the end of December, making it the best three-month stretch for stocks.

Not every stock, industry, or sector dishes out such gains, however. Some lag, and some outpace the broad market's gains.

While there's no such thing as a "sure thing" when it comes to investing, there are some industries that tend to fare considerably better than the norm, and they tend to do so with more than an average amount of reliability. Here's a closer look at the market's statistically best bets for the last three months of the year.

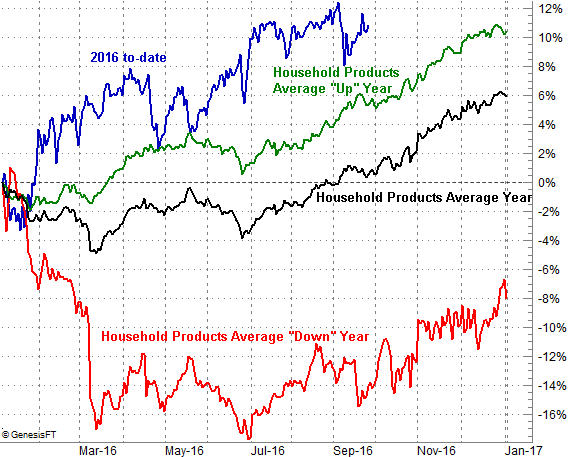

Household Products

It's not necessarily a monster-sized winner during the fourth quarter, but household products (XLP) tend to do pretty well in Q4 regardless of the environment or situation. On average, the group gains 5.5% between early October and late December. But, even in a "bad" full-year, the industry's stocks muster a gain of 5.9% during the fourth quarter.

The one thing working against household product this year is the fact that the sector is already leaps and bounds ahead of where it usually is at this point... even for a bullish year.

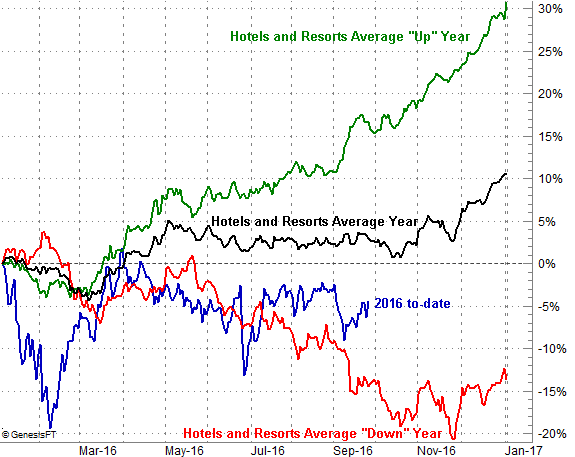

Hotels and Resorts

Hotels and resorts are another group of stocks that tend to do well between October and December, gaining an average of 8% for that timeframe. Even in a bad year the group just breaks even, typically, but when things are good (as they usually are), they're VERY good.

This year's been lackluster for the group's stocks so far, which leaves a little extra room or a year-end rally.

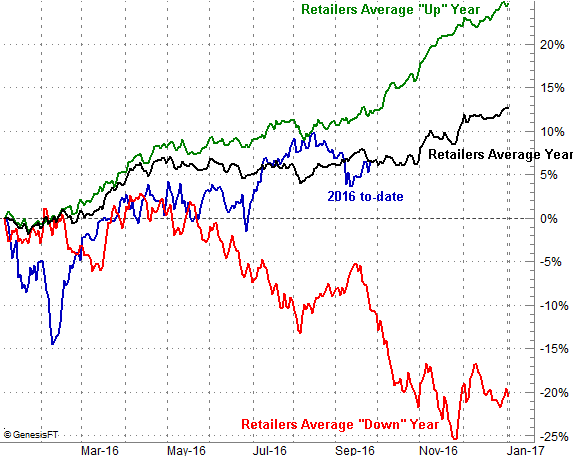

Retailing

Be careful here, as a bad year for retailing stocks (XRT) is VERY bad indeed. Fortunately, losing years are pretty rare for the group.

In any case, for the three month span about to begin, retailer stocks tend to advance about 6%, mostly driven by the connection investors make between then and the busy holiday shopping period. This year so far, retailers are right on track with their average performance.

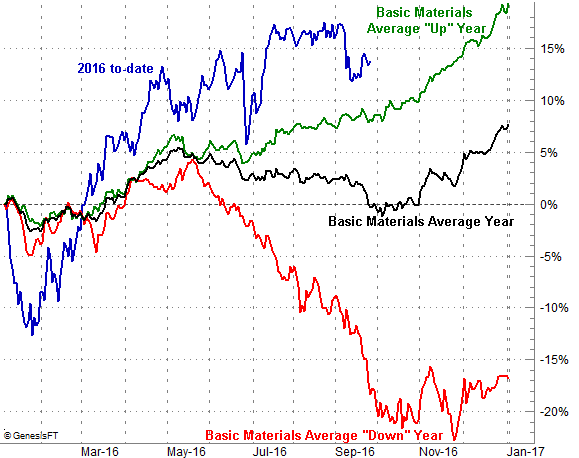

Basic Materials

Basic materials is another group that has been overly-hot so far this year, making it less likely to rally well during the fourth quarter. Indeed, the group is well ahead of its average when only counting bullish years. Nevertheless, this industry gains an average of 7.7% during the fourth quarter.

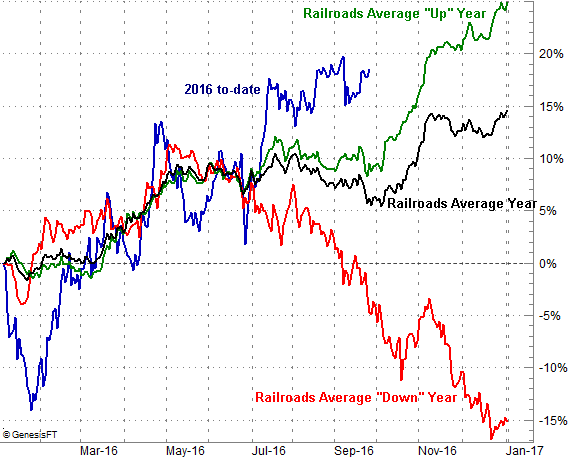

Railroads

Last but not least, railroad stocks usually dish out surprisingly strong gains during the fourth quarter, gaining an average of 8% for the timeframe in question. This isn't one a trader can afford to be wrong about, however. When it's bad, it's horrible. In the average losing year, the group loses 9.9% over the course of the last three months of the year.

Working against this group this year is the fact that these names are already mostly overbought.

Bottom Line

These aren't the industries one would expect to see earn a spot on the "best of" list for year-end performance. In fact, some of these Q4 winners are downright surprising. That's not exactly a surprise, however, in that for the obvious hot spot traders love to love tend to already have high expectations built into their prices. It's the off-the-radar names most traders rarely think of that often have the most room to run.