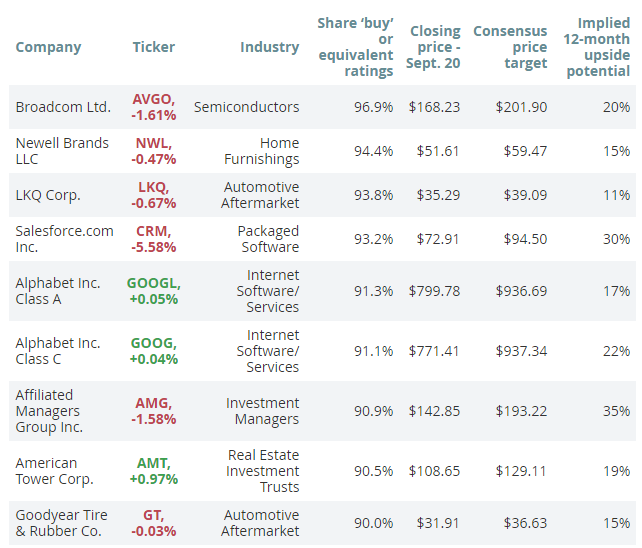

The 9 Stocks Most Loved By Wall Street Analysts

These are the nine most beloved stocks on Wall Street today

Their 12-month price targets range from 11% upside potential to 35%

You might not always trust Wall Street analysts, but their views on stocks can be useful. For one, you can see which companies they favor. And, second, which shares might still be undervalued, given the seven-year-plus bull market in U.S. stocks.

The games that companies and sell-side analysts play with quarterly earnings — lowering expectations to set up “earnings beats” — hurt the credibility of analysts. Their reputations also are hurt by their tendency to avoid putting “sell” recommendations on stocks. In fact, as of the close of trading Sept. 20, not a single S&P 500 (SPX) (SPY) SPX, -0.46% stock had majority “sell” ratings, according to FactSet.

But if you speak to a Wall Street analyst about an industry or a company, he or she will show impressive expertise and be able to justify his 12-month “buy,” “sell” or “hold” ratings pretty easily. Over the long term, analysts are also influential over stock prices as their consensus earnings estimates rise or fall.

Analysts often recommend buying shares of a company because the current stock price is considerably lower than where they think it should be, based on earnings and sales growth, cash-flow generation or other metrics. So there can be a great deal of logic behind a “buy” recommendation.

So we are listing, below, the stocks that are getting the most love from analysts. It might surprise you that there’s not a single stock among the S&P 500 with 100% “buy” or equivalent ratings. But here are nine with at least 90% positive ratings among analysts:

As you can see, two of Google parent Alphabet’s common share classes are on the list. The shares were split in April 2014, so that the company’s founders would more easily be able to maintain voting control. Leaving out a small number of Class B shares, all newly issued shares are Class C (GOOG) GOOG, +0.04% which don’t have voting rights. But Google has also been making ”adjustment payments” to Class C shareholders to ensure that earnings per Class C share match those of the Class A (GOOGL) GOOGL, +0.05% shares. So if you don’t care about having any say in how the company is run, the Class C shares are a better value.Here are forward price-to-earnings ratios for the group, along with estimated growth of earnings per share for 2017, which give an insight into whether each stock should be considered a growth or value play:The S&P 500 trades for 16.1 times weighted consensus estimates.

Here are forward price-to-earnings ratios for the group, along with estimated growth of earnings per share for 2017, which give an insight into whether each stock should be considered a growth or value play:

The S&P 500 trades for 16.1 times weighted consensus estimates.

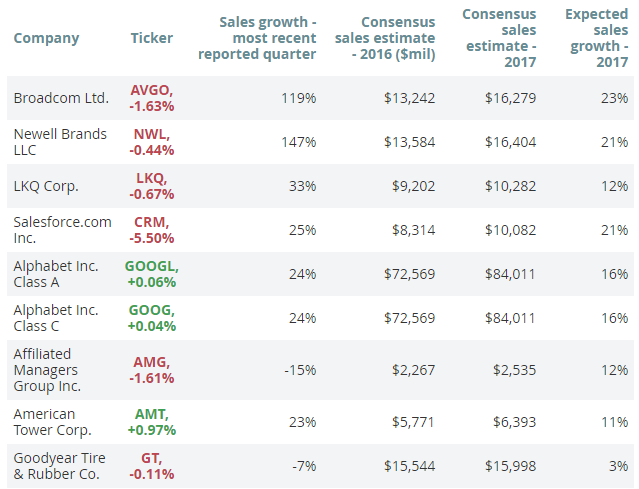

Here’s how successful the companies were in increasing sales over the past 12 months. We’ve also included full-year sales estimates for 2016 and 2017, to show how much revenue growth analysts expected from the company’s acquisition of Jarden Corp. in April. Newell said its “organic” sales growth for the second quarter was 5%.

The huge growth of sales for Broadcom Ltd. (AVGO) AVGO, -1.53% mainly reflects the company’s merger with Avago in February. For the combined company, sales were really up 7%, Avago said. The 147% growth of quarterly sales for Newell Brands LLC (NWL) NWL, -0.48% mainly resulted from the company’s acquisition of Jarden Corp. in April. Newell said its “organic” sales growth for the second quarter was 5%.

So Broadcom would appear to be in both the value and growth camps, based on the stock’s low forward P/E ratio and the double-digit expectations for earnings and sales growth in 2017. Affiliated Managers Group Inc. (AMG) and Goodyear Tire & Rubber Co. (GT) appear firmly in the value category, based on their declines in quarterly sales, although the former is expected to be the better grower in 2017.

The rest are all growth vehicles, with analysts expecting quite a bit of earnings and sales growth next year.

The purpose of listing these stocks is to provide food for thought. If you are interested in any of the companies, consider whether you believe their business strategies will continue to work for at least the next decade. Ask your broker for research reports, for more insight into why analysts love these stocks, and, as always, discuss your investment ideas with your broker or financial adviser.

Courtesy of marketwatch.com