These Stock-Market Sectors Will Be the Most Volatile in 2017: Goldman Sachs

Gold miners and biotech stocks could continue seeing big swings in the new year

By Ryan Vlastelica, MarketWatch

Investors in two of 2016’s wildest sectors won’t be getting a break from big swings in the new year.

Exchange-traded funds that track gold miners and biotechnology stocks, both of which saw massive daily moves last year, will remain “among the most volatile” in 2017, according to a Goldman Sachs analysis of the options market.

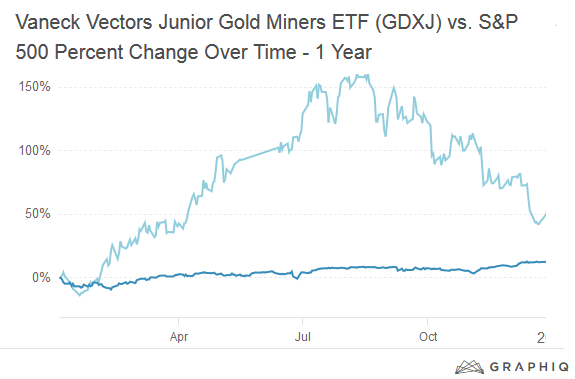

“Gold miners posted the best 2016 performance across our ETF universe, whether judged on an absolute or risk adjusted basis, and the options market is pricing in another big year for volatility for the VanEck Vectors Gold Miners ETF (GDX), and the VanEck Vectors Junior Gold Miners ETF (GDXJ)” the firm wrote in a note to clients.

According to Goldman’s analysis, the Gold Miners ETF could see a swing of as much as 34% in the coming year—either to the upside or the downside—while the Junior ETF, which focuses on small-cap companies in the space, could see a move of 44%.

While there are a variety of options strategies that investors can employ, a popular one is to use a “straddle,” where a call option and a put option are purchased at the same strike price. This is a bet that a security will move by a certain amount, rather than in a specific direction. A call option gives the holder the right but not the obligation to buy a security at a specific strike price. A put option gives the holder the right but not the obligation to sell at a specific strike price.

Both mining funds saw big gains last year, with the large-cap ETF up 52.5% and the Junior fund soaring more than 64%. They easily exceeded the 8.6% gain in the price of gold thanks to cost-cutting and improved margins. Despite that, the funds are heavily correlated to moves in commodity prices, which could lead to the volatility Goldman expects in 2017. By some forecasts, gold could fall below $1,000 an ounce this year; it is currently trading around $1,174. Others remain bullish on the precious metal, citing uncertainty over President-elect Donald Trump and the U.S. Federal Reserve.

Biotech stocks were also extremely volatile in 2016, with the iShares Nasdaq Biotechnology (IBB), falling 21.6% over the course of the year and the SPDR S&P Biotech ETF (XBI),losing 15.7%. The sector came under pressure due to a backlash over drug price hikes, an issue that became a political theme in the presidential election. Subsequent to his victory, Trump promised to “bring down drug prices,” implying legislation that, if enacted, could hurt the sector’s sales and profits.

According to Goldman’s analysis, the options market is pricing in a move of 23% for the iShares fund and of 31% for the SPDR fund. While the move could again to be to the upside or the downside, Goldman noted that “sentiment is bullish” for the sector.

Courtesy of MarketWatch