Strong Existing Home Sales Point to Rekindled Employment Market, Economy

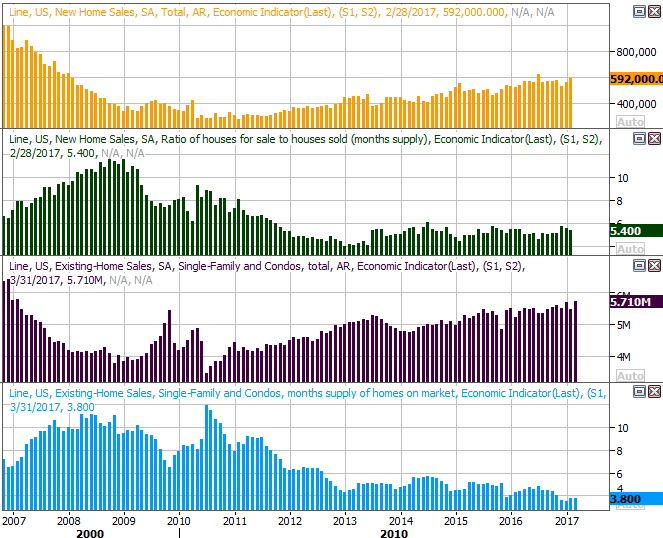

If anyone thought the real estate market was slowing down as a precursor to a contraction, they were wrong... at least based on March's evidence. The National Association of Realtors reported last month's existing home sales pace on Friday morning, saying home-buyers purchased already-built houses at an annualized pace of 5.71 million. That was a ten-year high. The surge came despite a continued lack of inventory. As of the end of last month, there was only a 3.8 month supply of homes on the market. That's still at multi-decade lows. A listing was only on the market for an average of 34 days last month, before being bought.

The NAR's chief economist Lawrence Yun commented on the report "The early returns so far this spring buying season look very promising as a rising number of households dipped their toes into the market and were successfully able to close on a home last month. Sales will go up as long as inventory does."

The statement acknowledges that a limited level of inventory is holding purchases back, though is also prolonging a string of higher sales prices. In March, the median existing-home price rose 6.8% year-on-year to $236,400.

Nationwide chief economist David Berson doesn't see the growth trend slowing down anytime soon either, saying "We expect existing home sales to trend higher over the course of 2017 despite modestly higher mortgage rates in response to solid job gains, faster income growth, and a pickup in household formations."

March's new-home sales report won't be posted until the coming week, though it's following a similar path as existing-home sales. Inventory levels of new-home sales stand at 5.4 months worth as of February, which is higher than the 2012 low, but still below the long-term average. Sales of new homes also reached a multi-year high pace of 592,000 units in February. Again, a lack of inventory may be keeping the brakes on purchase activity, with many homebuilders not willing to overextend themselves in fear of a repeat of 2008's debacle. New home construction is still nowhere near 2008's levels though.

All the data points to economic strength, indicating that consumers are not only willing to make new financial commitments, but able to do so. Although wages have yet to show meaningful improvement, with employment almost at maximum levels and near the Fed's "full employment" benchmark, higher wages should soon follow. As Berson described, that could keep the heat turned up on this trend.