S&P 500 Earnings Decline For 5th Straight Quarter

S&P Earnings Decline for Fifth Consecutive Quarter

by John Butters

With 98% of the companies in the S&P 500 (SPX) (SPY) reporting earnings to date for Q2 2016, 71% have reported earnings above the mean estimate and 53% have reported sales above the mean estimate. What other notable movements have occurred in the S&P this quarter?

Earnings Growth

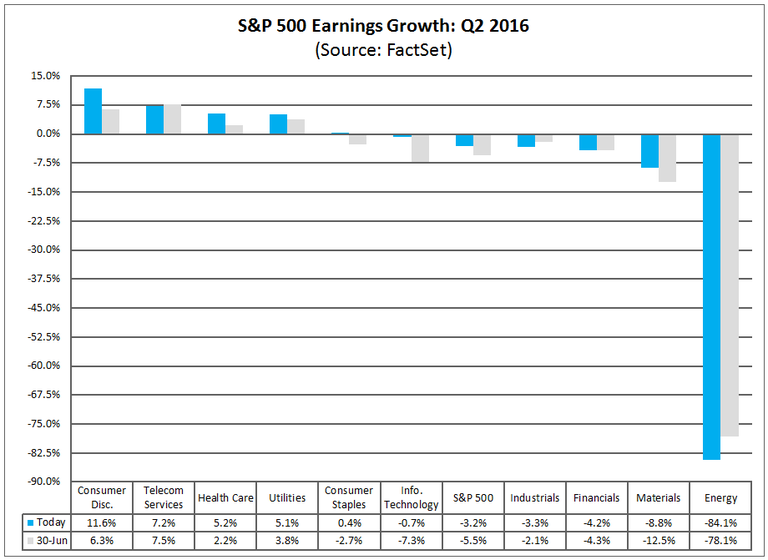

For Q2 2016, the blended earnings decline for the S&P 500 is -3.2%. The second quarter marks the first time the index has recorded five consecutive quarters of year-over-year declines in earnings since Q3 2008 through Q3 2009.

Earnings Revisions

On June 30, the estimated earnings decline for Q2 2016 was -5.5%. Seven sectors have higher growth rates today (compared to June 30) due to upside earnings surprises, led by the Information Technology (XLK) and Consumer Discretionary (XLY) sectors.

Earnings Guidance

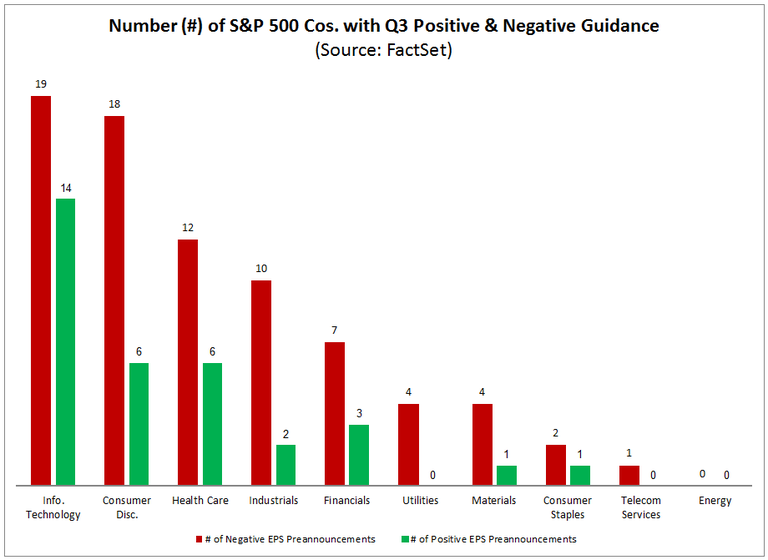

For Q3 2016, 77 S&P 500 companies have issued negative EPS guidance and 33 S&P 500 companies have issued positive EPS guidance.

Valuation

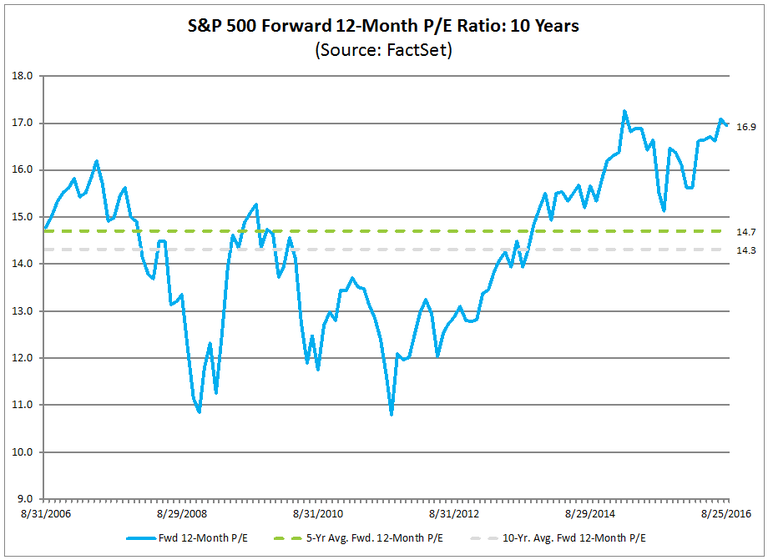

The forward 12-month P/E ratio for the S&P 500 is 16.9. This P/E ratio is based on Thursday’s closing price (2172.47) and forward 12-month EPS estimate ($128.77).

Courtesy of factset.com