One Well-Known Permabear Is Turning (Mildly) Bullish

Be very afraid: Permabear Faber is starting to sound downright bullish - Gold vulnerable to near-term correction after rally

Has Wall Street’s favorite permabear lost his teeth? A recent chat with Marc Faber about the outlook for global markets might lead one to conclude that the longstanding global-market pessimist espouses a much more subdued outlook for stocks — even one that’s furtively upbeat.

The Swiss investor, who publishes the Gloom, Boom & Doom Report, told MarketWatch that equities, which lately have been plodding toward fresh records, may remain buoyant if central banks continue to unfurl economic stimulus measures around the globe.

“I am negative about the global economy, but if you print enough money, the market may not go down in nominal terms” Faber said.

Perhaps even more significant — contrasting with the starkly bearish view espoused by billionaire hedge-fund investor George Soros — Faber suggests that China, though facing serious headwinds as it struggles to avoid a so-called hard landing, may be able to orchestrate a touchdown without roiling the rest of the world.

“China has a credit bubble. That is known,” said Faber. “The question is, to what extent can the credit bubble be deflated without causing any major disruptions? And I think that it is possible,” he said.

Repercussions of a slowdown of the world’s second-largest economy have been playing out for months. Nearly a year ago, concerns about the health of the Chinese market fueled a selloff in U.S. stocks. But U.S. stocks have stabilized since then, with the S&P 500 index SPX, -0.56% and the Dow Jones Industrial Average DJIA, -0.35%on the verge of hitting new records for the first time in more than a year.

Faber’s current take on the market comes after an earlier call for an epic crash by the S&P 500 — he predicted in January that the large-cap benchmark could fall to a 5-year low — has failed to materialize so far. The permabear bristles at the suggestion that his calls were wrong.

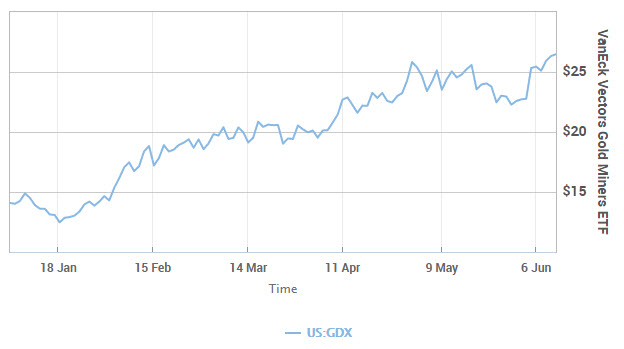

Instead, he points to his recommendations in precious metals and gold-mining shares, which have panned out considerably well, boasting sharp year-to-date returns. In the face of some $10 trillion in debt, bearing negative interest rates across the globe and mounting fears that the U.K. might abandon the European Union, gold futures GCQ6, +0.48% and the SPDR Gold Trust exchange-traded fund GLD, +0.38% are both up about 20% in 2016, while the mining-focused VanEck Vectors Gold Miners ETF GDX, +0.72% has nearly doubled. Weakness in the U.S. dollar DXY, +0.25% also has helped to support that rise, making dollar-priced assets cheaper to buyers using other currencies.

Faber says the run-up in gold and other metals might now leave the complex vulnerable to a pullback.

“An investor has to realize that once a stock has moved up from its lows…consolidation should be expected, even a correction,” he said.

Faber believes most portfolio managers fail to have sufficient exposure to gold, which is typically used as a hedge against inflation and market uncertainty, but may be “embarrassed” to purchase the commodity now at its current price. As a consolation, Faber recommends considering buying mining stock Freeport-McMoRan Inc. FCX, -3.35% which he believes still has upside.

Is it fair to describe Faber as outright bullish on stocks? Perhaps that’s a reach.

“I am bearish about the world,” he said, “and I think the U.S. stock is more than fully priced and is vulnerable to a significant decline.”

Certainly, the likes of Soros are bracing for the worst. Outspoken activist Carl Icahn said on CNBC on Thursday said Soros’s bearish bets have merit, given artificially low rates that have proliferated across the globe. “I can’t help but think he has a couple of real good points,” he said.

Broadly speaking, investors appear to be expressing caution as well, throwing money into havens, like government bonds.

Indeed, the yield on the 10-year benchmark note closed at its lowest level in about four months on Thursday. And the yield on Britain’s equivalent, the gilt TMBMKGB-10Y, -0.89% hit an all-time low of 1.245%, as did Germany’s benchmark bund TMBMKDE-10Y, -36.29% which was at 0.037% late in New York.

Despite the degree of nervousness being expressed though the lens of the buying of government debt, stocks held up relatively well Thursday and look set to shrug at bears like Faber.

Of course, avoiding a bearish outlook and eschewing stocks back during the market’s nadir on Feb. 11 would have left investors out of a healthy rally that has seen the S&P 500 rise nearly 16% and the Dow up around 15%. U.S. benchmark crude-oil futures CLN6, -1.68% also have nearly doubled during that period, up about 93%.

Courtesy of marketwatch.com