This Chart Says a Selloff is Looming as Fear Stalks the Stock Market Rally

Stocks may see a correction of between 2% to 10%

Wall Street’s so-called fear index has started to move in lockstep with stock prices and that has one money manager warning of an impending selloff even as market sentiment remains fairly stable.

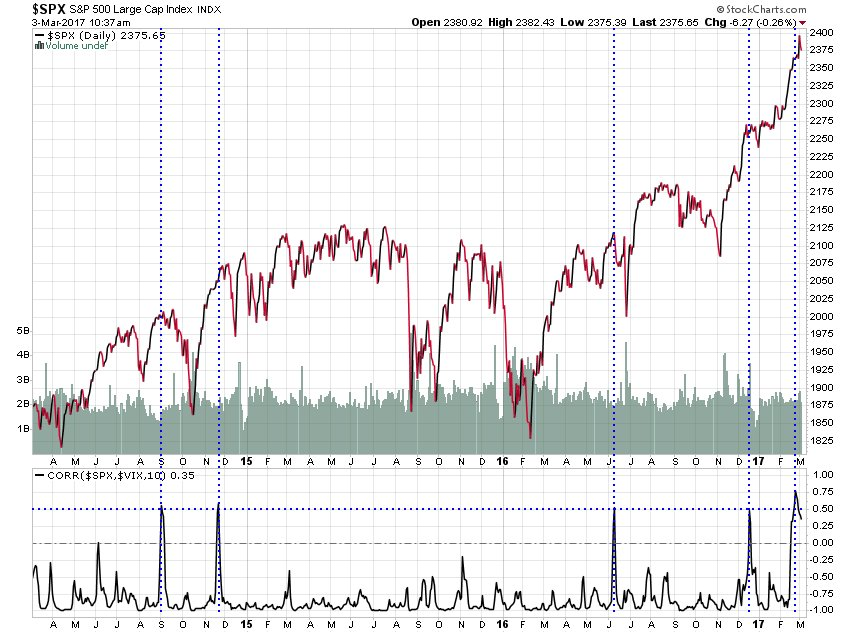

Jesse Felder, founder of the Felder Report and an alumni of Bear Stearns & Co., on Friday shared a chart that showed an increasingly positive correlation between the S&P 500 and the CBOE Market Volatility Index.

“Normally stocks and the VIX move in opposite directions…and it makes sense that rising stock prices mean less fear and vice versa,” said Felder.

However, that reverse relationship has started to change in recent days as expectations of a market correction mount.

The VIX is a measure of the market’s expectation for volatility over the next 30 days and is calculated from the implied volatilities of S&P 500 index options. A low reading indicates a placid market while a higher number suggests elevated uncertainty.

“The options market is pricing in greater volatility ahead even though stocks don’t yet reflect this same dynamic,” Felder told MarketWatch. “Over the past few years this signal has preceded anywhere from a 2% to a 10% correction.”

That this trend comes on top of the 10-year Treasury yield’s nearly 40% surge over the past year as the Federal Reserve prepares to tighten monetary policy suggest risky assets such as equities will face significant selling pressure.

Analysts are projecting the Fed to raise interest rates three times this year, a view reinforced by comments from Fed Chairwoman Janet Yellen on Friday that a rate hike at the next Federal Open Market Committee in mid-March is likely.

“The Fed looks like it will take its third step toward tightening here soon so it might pay to remember the old Wall Street adage ‘three steps and a stumble.’ For these reasons, I think the chance of a major reversal is higher than it has been in the past,” he said.

Stocks are lower for a second day in a row on Friday but major indexes are still trading near record territory following a monster rally sparked by President Donald Trump’s pro-business agenda.

On Friday, the S&P 500 (SPX) edged up 1.20 points to finish at 2,383.12 while the Dow Jones Industrial Average (DJIA) ticked higher in late trade to close at 21,005.71 and the VIX slid 0.85 to 10.96.

Courtesy of MarketWatch