Macy's (M) Disappoints, But Isn't The Whole Retailing Sector (XRT)

Macy's (M) Disappointing Outlook Isn't an Industry-wide Omen

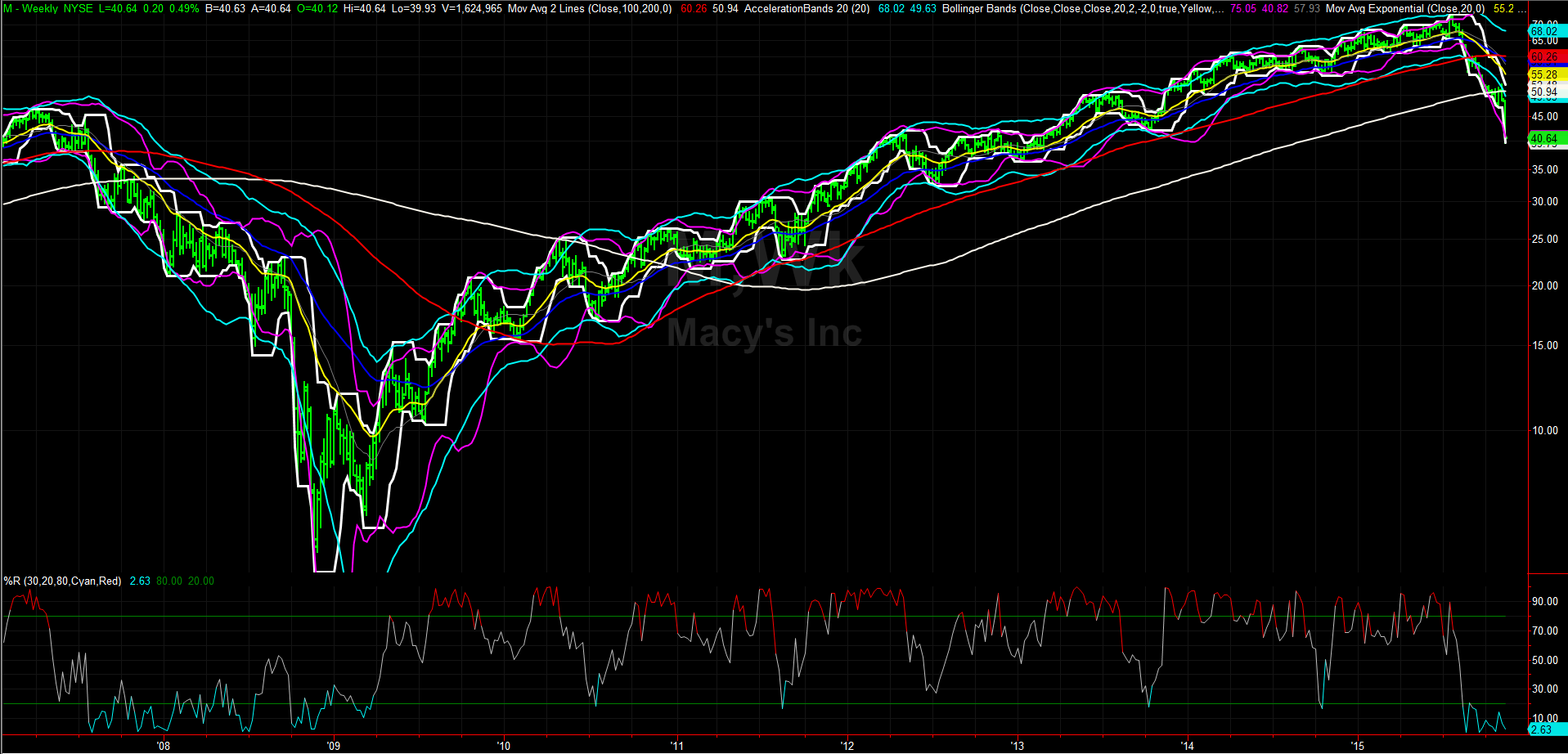

Macy's (M) may have managed to top its third quarter earnings estimates, but between its revenue shortfall and a dialed-back earnings outlook, spooked investors sent the stock down a hefty 12% on Wednesday.

All told, the department store chain posted a profit of 56 cents per share on $5.87 billion worth of sales. Analysts were collectively expecting a profit of only 53 cents per share, but the Q3 top line missed estimates of $6.09 billion. It didn't help that both the top and bottom line were remarkably less than year-ago comparisons to earnings of 61 cents per share and revenue of $6.2 billion. Same-store sales fell 3.9%.

While still profitable, another round of deteriorating results is forcing the retailer to consider the sale of some of its real estate, leading to the possible closing of stores even beyond the previously-announced closure of 35 to 40 locations.

The real damage to the stock's price, however, was more likely the result of a disappointing outlook for all of 2015. Now the company is expecting earnings to roll in between $4.20 and $4.30 per share, versus prior expectations for a profit of between $4.70 and $4.80.

Be that as it may, a poor showing from Macy's last quarter isn't inherently an indictment of the entire retailing industry (XRT).

Although its official third quarter numbers won't be posted until Friday morning, beleaguered department-store chain JC Penney (JCP) told investors this morning that its same-store sales figure for calendar Q3 was up 6.4%. Analysts expect JC Penney to post a loss of 56 cents per share on sales of $2.88 billion for Q3, both of which are better than the year-ago loss of 77 cents per share and revenue of $2.76 billion.

In between JC Penney and Macy's, Kohl’s (KSS) is expected to report earnings of 72 cents per share on Thursday, with revenues of $4.41 billion anticipated. Kohl's earned 70 cents per share in the third quarter of 2014, on sales of $4.37 billion. It should be noted that although Kohl's only tops profit estimates about half the time, it's very reliable in terms of y-o-y earnings growth.

The mixed results and outlook only further muddy the holiday spending outlook for 2015. The National Retail Federation officially predicts year-over-year sales growth of 3.5% in (jointly) November and December, which is better than the 10-year average increase of 2.5%, yet has still been deemed lackluster by some industry experts. But, Macy's weakness seems to be more of an exception to the norm than the norm.