Lack Of Bullish Sentiment Indicates More Upside Potential For Market

Technical analyst finds counterintuitive reason for stocks to rise

Investors are skittish, and that means the market's recent gains are set to continue, according to Oppenheimer technical analyst Ari Wald.

"We're not seeing the type of euphoria that you typically see at a major top in the market," Wald said Monday on CNBC's "Trading Nation."

He points to what happened to sentiment just at the beginning of the month, as the market slid.

The S&P 500 (SPX) (SPY) fell as much as 3.4 percent from its August peak, which is "a run-of-the-mill pullback, but as soon as you get that first whiff of downside volatility, you really see the bulls run for the exits."

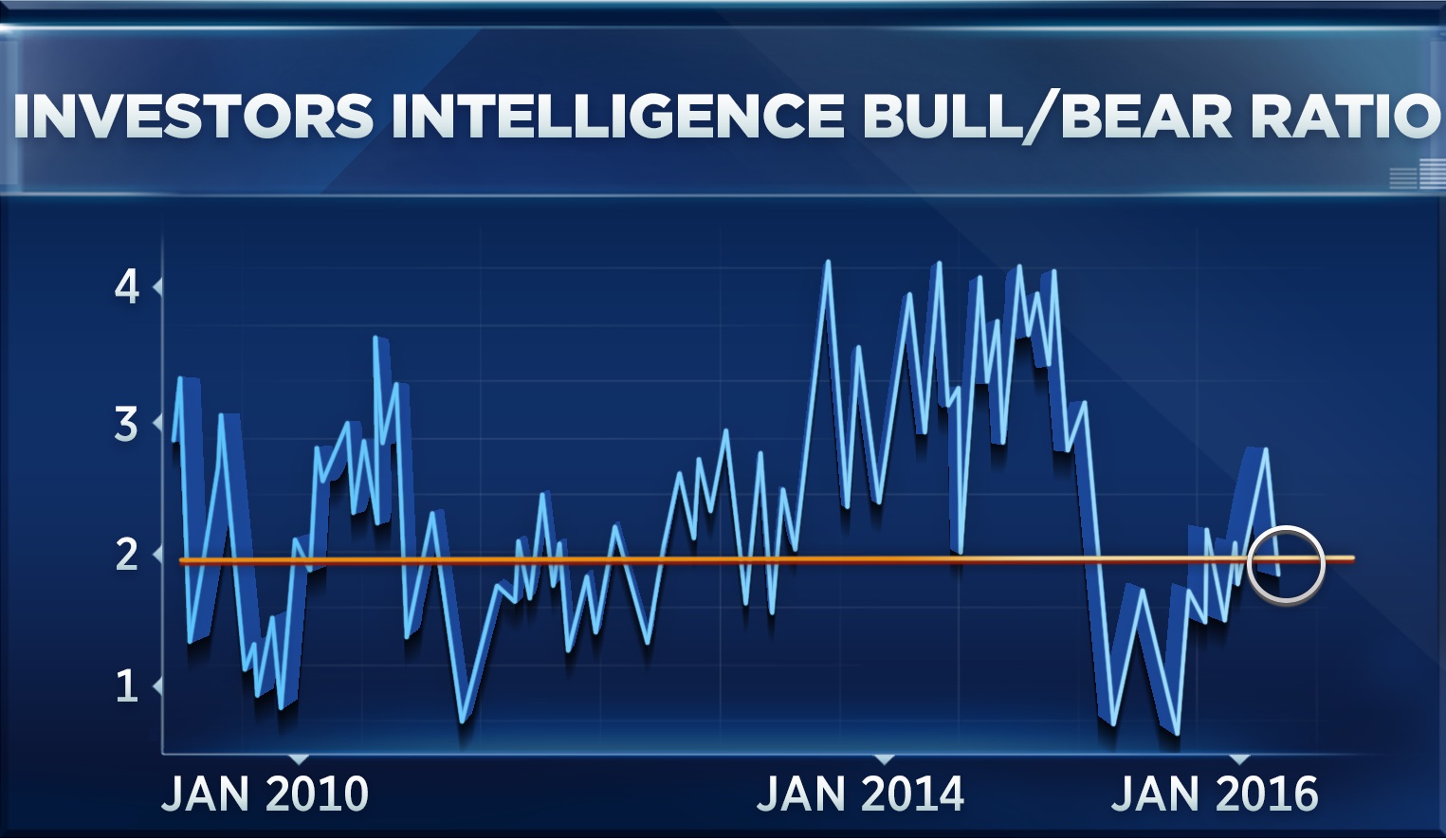

To make his point, Wald furnishes the chart of bullish-to-bearish sentiment as measured by Investors Intelligence, a "contrarian indicator," so called because when it shows a higher degree of bearishness, stocks are seen as more likely to rise.

This pessimistic sentiment is "one more reason we're bullish on equities."

Indeed, the technical analyst explains that many institutional portfolio managers have been "underinvested" in stocks, leaving him to ask rhetorically: "Who's left to sell when everybody's already sold?"

Yet for Kathy Lien, a macro strategist and currency trader at BK Asset Management, investors now have a good reason to be pessimistic.

The close election between two quite different candidates "is going to make domestic and global investors nervous, and they are going to be wary of holding stocks at these high levels," Lien said Monday on "Trading Nation."

"So I do fear that we could see a deeper correction in stocks," Lien added, saying that a "Christmas collapse" could be in the offing.

Courtesy of cnbc.com