Did the S&P just crush this ‘irrefutable’ sell signal?

Is this the beginning of the end? The S&P 500 (SPX) (SPY) (and most other major market indexes) just got struck by the ominous “death cross.”

An irrefutable sell signal?

This is not just your average death cross — where the 50-day simple moving average (SMA) drops below the 200-day SMA — it's an even more potent death cross, where the 50-week SMA drops below the 100-week SMA.

According to some, this is an irrefutable stock-market sell signal. But is it really?

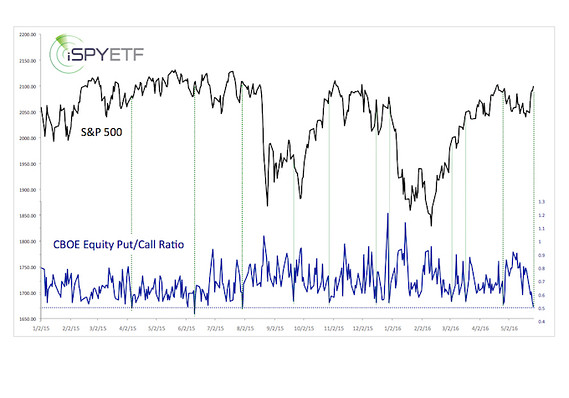

The chart below provides a visual of the last three 50/100-week SMA death crosses.

The March 2001 and June 2008 death crosses occurred as prior stock-market bubbles popped.

I may disappoint permabears when I say this, but just because it happened twice before, doesn't mean it will happen again. Also, no stock market signal is ever irrefutable.

Irrefutable losses

Since the death cross and the “irrefutable” sell signal, the S&P 500 rallied as much as 60 points. One fact that differentiates this death cross from the prior two, is that the actual SMA crossover occurred below the S&P 500.

Irrefutable logic

The 50-and 100-week SMA crossover around S&P 2030 level created strong support (see chart insert above). The initial focus should have been on the support provided by the death cross, not the potentially bearish implication. No 2000- or 2008-style meltdown can happen without breaking below support first.

In addition to the death cross, there was much talk about a bearish head-and shoulders formation with the neckline near 2040. However, the Profit Radar Report warned against turning bearish prematurely, pointed to support at 2,025, and anticipated a seesaw move across the widely watched 2040 support level.

The May 22 Profit Radar Report stated that: "Stocks delivered the fakeout move we anticipated. The recovery from Thursday's low was strong enough to lead to further gains. A move above 2,065 could lead to 2,085+/-."

As it turns out, the 2085+/- upside target was easily surpassed.

It may be too early to consider the “irrefutable sell signal” crushed, but it has certainly been a painful delay for those who bet on falling prices at S&P 2,040.

Another shot for bears?

Earlier this week, the CBOE Equity Put/Call Ratio dropped to 0.51, the lowest reading since July 30, 2015. As the dashed green lines show, this tends to limit upside potential and gives bears another shot at taking stocks lower.

This report highlights three more reasons why bears may get their 15 minutes of fame, but there are also two misconceptions that could trick indiscriminate bears.

Courtesy of marketwatch.com