Inside The Explosive Growth In ETF Options Volume

That Giant Sucking Sound You Hear Is the ETF Options Market

Options on exchange-traded funds are soaring.

by Eric Balchunas & Tracy Alloway

As investors rush to protect their portfolios in a tumultuous start to the year, odds are they will be using options on exchange-traded funds to do it.

While much of the recent focus on the ETF phenomenon has centered squarely on their inflows and trading growth, they are quietly becoming the epicenter of the equity option market.

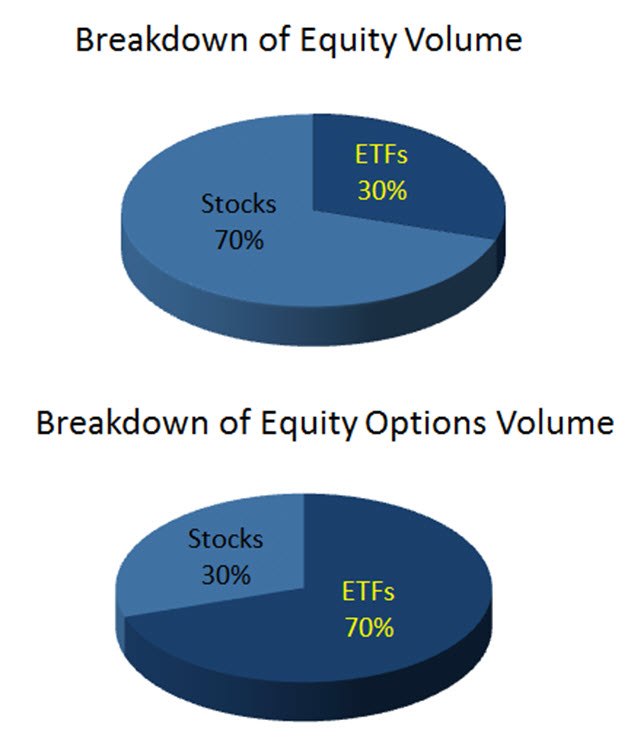

ETFs now account for about 70 percent of all equity option volume, or $770 billion of the approximate $1.1 trillion traded per day, using a sample of the past 20 trading days. That's double what the average volume was five years ago, at a time when more people than ever are buying and selling puts and calls on ETFs than they are on individual stocks.

The option volume of ETFs relative to stocks is effectively the reciprocal of overall equity trading—where ETFs make up about 30 percent to stocks’ 70 percent, as illustrated in the two charts below.

The juggernaut behind this outsize volume is the SPDR S&P 500 Trust ETF (SPY), which by itself accounts for $554 billion—or nearly half—of the $1.1 trillion traded each day in equity options. And that's out of a universe of nearly 1,000 equities that have options tied to them.

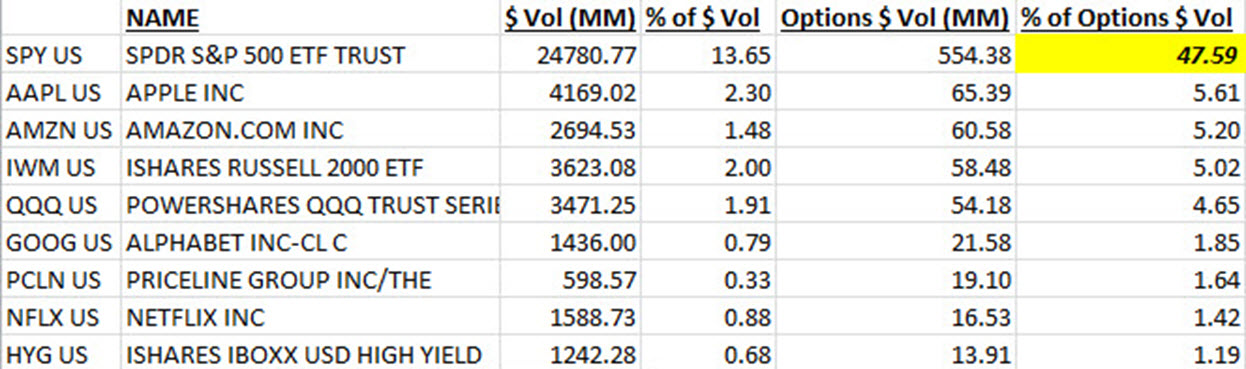

The table below shows the most active equities and the difference between their actual trading and their option trading. This highlights the fact that SPY accounts for "only" 13.6 percent of equity trading but an outsize 47.6 percent of option trading. This jump, to $554 billion, is a 100 percent increase from just five years ago.

Where is all this liquidity in SPY options coming from? As with flows, it's difficult to pin down exactly where ETFs are luring activity from, since all trading in such funds is anonymous. Nevertheless, some of it is coming from individual stocks themselves—which overall have seen a decline in option volume over the years relative to the whole market. In addition, SPY is most likely sucking volume away from options on S&P 500 Index futures, which trade about $160 billion a day.

The next question is why investors are flocking to options on the SPY in particular? The ETF's unearthly option volume can be attributed to a few things. First, it's becoming money managers' go-to way to insure or hedge a portfolio, which makes sense given the $2.2 trillion currently benchmarked to the S&P 500 Index. The idea of insuring market positions using options on a fully funded security such as an ETF is what attracted some early big investors to SPY back in the 1990s.

Volume is also coming from all kinds of speculative trading strategies. For example, traders will try to arbitrage SPY’s options vs. its futures vs. the ETF itself. But again, this happens in many securities. This brings us to what really sets SPY apart: the size of the investors.

SPY proves on a massive scale that liquidity begets liquidity. Once everyone began using SPY options, trading spreads nearly disappeared and bigger fish—both in the U.S. and overseas—started using them as well. Some of the biggest holders of SPY options include BlackRock, Citigroup, Goldman Sachs Group, and Citadel, according to the latest filing data on Bloomberg.

These big fish jack up the dollar volume figures because their orders are so large. SPY–and its related option market—can absorb billion-dollar trades without missing a beat. And those big-ticket, big-fish trades add up quickly.

“It becomes a domino effect. One investor sees a $2 billion trade, and that gives them confidence to do their large trade. These big trades bring out more liquidity,” says Mohit Bajaj, director of ETF trading solutions at WallchBeth Capital.

SPY aside, ETFs as a group are also seeing increasing option volume relative to stocks because they pull in new dollars from outside the actual stock market, thanks to the asset classes they track. For example, the SPDR Gold Trust (GLD)—which also sees about $1 billion a day in options trading—is pulling in action from the commodity futures market.

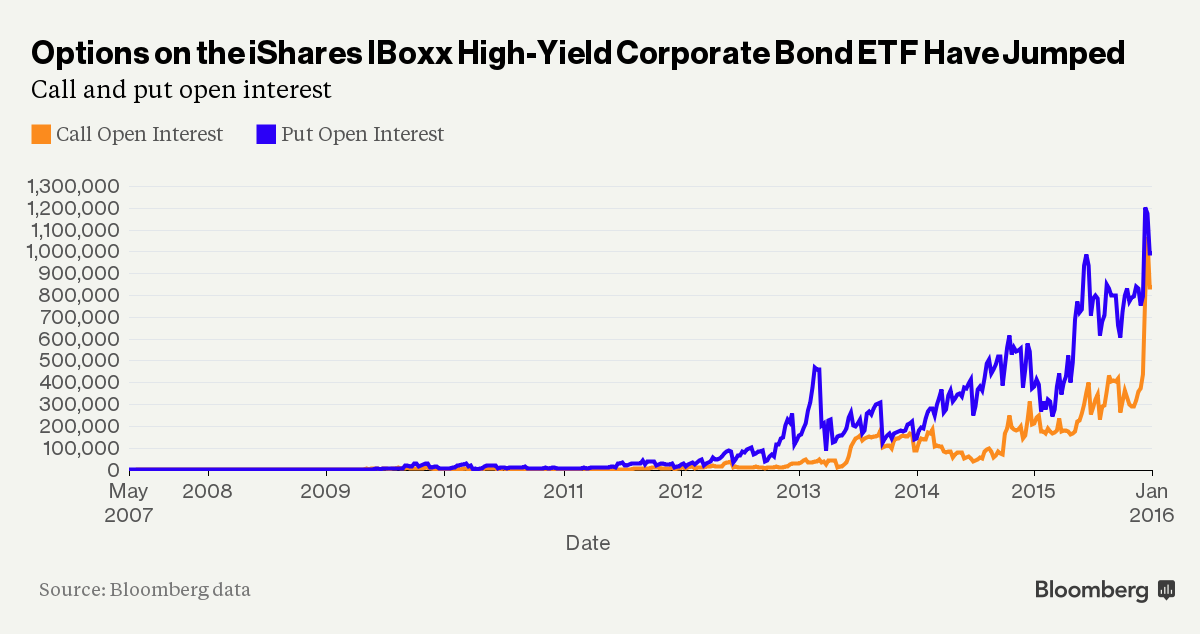

Meanwhile, the iShares iBoxx High Yield Corporate Bond ETF (HYG) has seen more than $1 billion a day in option volume over the past couple weeks, as investors search for new ways to protect their holdings of corporate bonds.

"Credit managers are increasingly using HYG options as a liquid hedge; previously they had used VIX (VIX) (VXX) calls and S&P 500 puts in part because HYG options were not as liquid," says Pravit Chintawongvanich, head derivatives strategist at Macro Risk Advisors, referring tied to the Chicago Board Options Exchange's Volatility Index. "With the HYG options market becoming more liquid, I’d expect it to be increasingly adopted as a hedge to credit positions."

The question is how much more liquidity can ETFs drain from other markets—be they stocks, commodities, or bonds—before they become the only market?

Courtesy of bloomberg.com