For Chevron (CVX), It's All Up to Oil Prices Now

Not only were the numbers Chevron (CVX) posted for its first fiscal quarter of 2016 well short of its comparable numbers from Q1 of 2015, both the top line and the bottom line missed estimates.

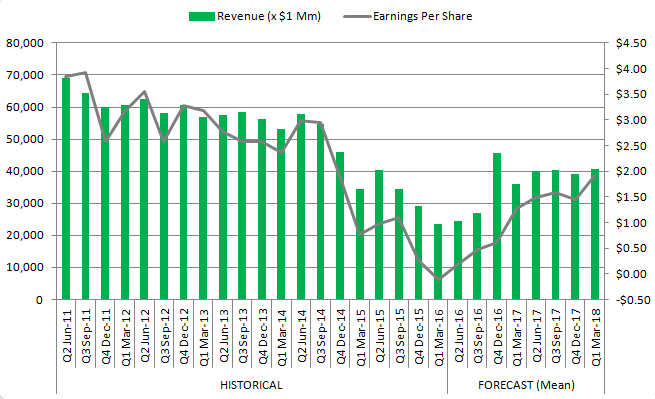

In the first quarter of 2016, oil giant Chevron lost $725 million, or 39 cents per share, on sales of $23.6 billion. Pros had estimated a loss of only 17 cents per share and revenue of $24.5 billion. In the same quarter a year earlier, per-share profit rolled in at $1.37, and sales totaled $34.6 billion.

The deteriorating numbers were, somewhat obviously, the result of ongoing deterioration in the price of crude oil (USO) and natural gas (UNG). In the United States, the company's average selling price per barrel fell from $43 in the first quarter of 2015 to only $26 per barrel in the first quarter of 2016. Natural gas prices fell from $2.27 per thousand cubic feet a year ago to $1.32 per thousand cubic feet last quarter. Overseas gas and oil prices declined by about the same degree.

The focal point for current and would-be Chevron investors from here is expense control relative to persistent weakness in crude oil prices.

Last quarter's capital expenditures and exploration expenses fell from $8.6 billion to $6.5 billion, putting the company on track to spend its targets budget of about $25 billion on capital expenditures this year. That's about 25% less than the company's 2015 capital expenditures. Most other optional expenses have already been culled.

That still won't be enough to push Chevron back into the black without a little help from oil prices though.

On the flipside, a little bit of strength from crude could provide some oversized relief to what's not -- in percentage terms -- a completely horrifying bottom line.

Of course, with crude prices up 48% since the middle of February and reaching new multi-month highs thanks to today's new multi-week lows from the U.S. dollar, the possibility of such help arriving can't be dismissed as mere hope.

The visualized trend and projections better illustrate where last quarter's numbers fit into the bigger earnings and revenue trend. Bear in mind the forecast is based on a measurable, albeit minor, improvement in the price of crude oil... a forecast that isn't particularly out of reach should oil prices hold onto their recent gains.