Inside The Baltic Dry Index & Maritime Transportation Index Moves

Maritime Shipping Stocks May Have Just Turned a Corner

The past couple of years have been tough ones for marine transportation names such as Scorpio Bulkers (SALT), Safe Bulkers (SB) and Teekay Tankers (TNK). Not only did oil prices (USO) suffer a price-implosion and corresponding demand for crude, dry commodities like grains (JJG) and iron ore pellets also hit a wall; there was no safe haven within the maritime shipping realm.

Along with the recent rebound effort from oil and other commodities, however, we're seeing similar hints of a rebound effort from these long-beaten-down marine transportation names. Though still speculative, the Dow Jones Marine Transportation Index (DJUSMT) has dropped a hint this week that the recent strength may be more than just a little volatility.

The chart below tells the tale. After a capitulatory move was made in January, the bulls have following through on the initial rebound. For a few weeks in March it looked as if a ceiling at 204 would quell the rally effort before it got going in earnest, but thanks to this week's move, the index has hurdled that line as well as moved above the 200-day moving average line (green) for the first time since 2014. The volume behind the move this week so far hasn't been great, but now that a couple of key ceilings have been cleared, the volume that started this upward move may well materialize again... and in a much bigger way this time.

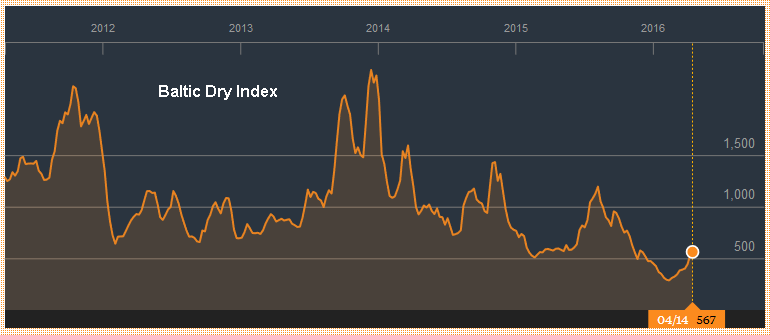

As for the core cause of this renewed interest in long-beleaguered shipping stocks, one only has to look at the similar rise of the Baltic Dry Index.

The Baltic Dry Index, in simplest terms, measures the daily rate to charter a vessel that hauls dry goods like grains, coal (KOL), fertilizer, gravel, and the like. It changes as demand changes; shippers raise or decrease their charter rates to find the right balance between maximizing profitability and maximizing competitiveness. Either way, if it's falling, demand for shipping is weak, which generally corresponds with weak commodity prices. A rising Baltic Dry Index corresponds with strong commodity prices.

The Baltic Dry Index is rising. In fact, it's been rising since mid-February.

Clearly the Baltic Dry Index is no stranger to volatility. Indeed, all of the rally efforts since 2014 have ultimately resulted in lower levels. Shipping rates can't move lower indefinitely, however, and in the same sense that weak oil prices are finally starting to drive some oil and gas stocks into bankruptcy and/or ceased operations, weak shipping rates may have finally flushed out the oversupply of maritime shippers... dry bulk as well as oil. That, coupled with renewed demand for commodities (oil and otherwise), put shipping stocks in a good position for the future. The shape of the Dow Jones Marine Transportation Index says the market is starting to pick up on this premise.

Don't misread the message. Scorpio Bulkers Safe Bulkers, Teekay Tankers, and all their dry-bulk as well as oil peers and rivals still pose enormous risk. Many remain unprofitable, and will for the foreseeable future. And, they're still ultimately a bet on the current commodity rebound extending indefinitely. The risk and potential reward, however, just became a much more interesting, compelling opportunity.