Inflation & Dollar Should Give The Fed Breathing Room

Inflation Remains in Check, Giving Fed Breathing Room (if the Fed cares to use it)

If Janet Yellen was aiming to raise interest rates because she felt inflation was going to race out of control in the very near future, she didn't need to be concerned. It isn't. Indeed, inflation is still anything but rampant, on any front.

This week we heard the United States' key inflation numbers... producer price inflation rates on Tuesday, and consumer price inflation rates on Wednesday, just a few hours before the Federal Reserve's Open Market Committee was scheduled to make a decision regarding an interest rate hike. There is no inflation to speak of. In fact, we're tiptoeing into deflation territory.

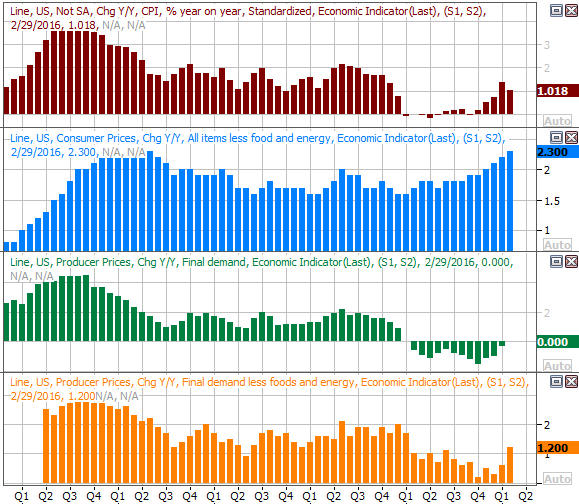

Last month, the overall producer price index fell 0.2%, and even on a core (minus food and energy costs) producer prices were flat. On an annualized basis, the producer price inflation rate now stands at 0.0%, and the core annualized producer inflation rate is 1.2%. [That's the highest core inflation rate we've seen since 2014.]

As for consumer inflation, overall prices were down 0.2% on February, though were up 0.3% on a core basis. On an annual basis, the consumer inflation rate now stands at 1.02%, though is a reasonably healthy 2.3%.

While both core inflation measures look fairly firm on an annualized basis, just bear in mind that a year ago, even core inflation rates were closer to the tepid, weak end of the scale, making for low comparisons this time around, exaggerating the number now. On an absolute or long-term historical basis, most prices are still low on all fronts.

It's also worth noting that the U.S. Dollar remains strong despite a couple of recent efforts to finally send it lower after 2014's and early-2015's heroic rise. As long as the greenback holds its ground -- and so far it's had little problem doing so -- inflation is going to remain relatively muted on an absolute basis even if the annual numbers starts to creep beyond the Fed's target level of around 2.0%. If the U.S. Dollar Index breaks below 93.0, that could be a reason to worry.