How Inflation Could Alter The Investment Landscape

Is it finally time for the inflation trade?

After false starts, it could be the start of a major shift

Is inflation finally ready to take hold? Some investors are betting on it.

The return of inflation would mark a major shift in what’s driving financial markets. If, in response, central banks beyond the U.S. begin scaling back unprecedented stimulus, including aggressive bond-buying programs, allowing government bond yields begin to rise, it could mark the end of the insatiable “hunt for yield” that has driven risky assets to record heights.

Torsten Slok, chief international economist at Deutsche Bank, thinks investors aren’t fully aware of the stakes.

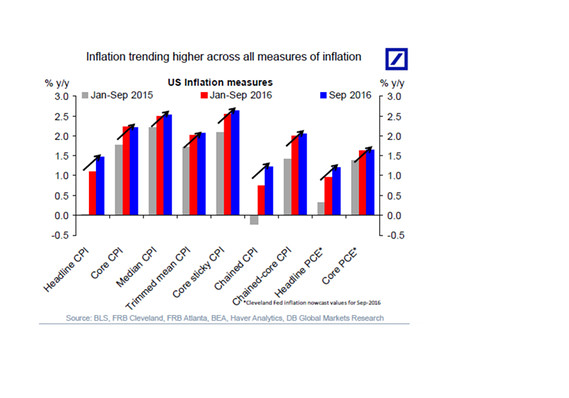

“There are more and more signs of inflation everywhere…and the market continues to ignore what it means for the Fed and for the level of rates, and fixed income more broadly,” he said in a Friday note.

Indeed, some economists, including Slok’s Deutsche Bank colleagues, argue that the 35-year bull market in government bonds is in its final throes, if not already over. If so, that’s the completion of a trend of ever-lower borrowing costs and the asset trends that have accompanied, could soon reverse.

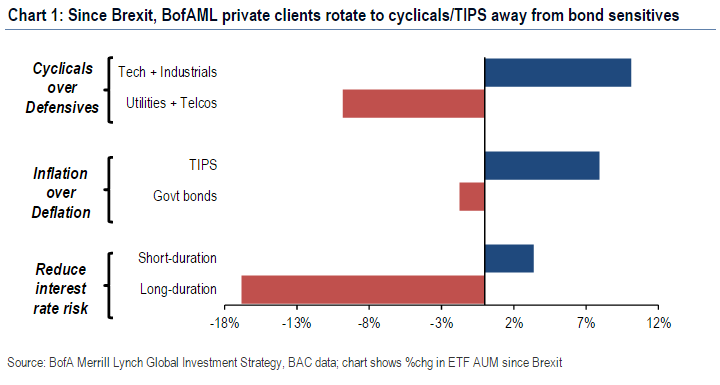

It is still early days, however, and the so-called inflation trade has seen its share of false starts since the end of the financial crisis. But in their weekly “Flow Show” note on Friday, analysts led by Michael Hartnett at Bank of America Merrill Lynch offer the chart below, which shows the degree to which private clients have started to rotate into cyclical stocks, which typically do better as the economy grows, and Treasury inflation-protected securities, or TIPS, which are designed to protect against inflation.

Those investors are rotating out of assets like Treasurys (TLT) and stocks that tend to behave more like bonds.

Broader flow data shows a similar theme, with TIPS posting a 19th week of inflows, while bank loans, emerging-market debt and equity funds and materials (XLB) continued to see inflows, they said. Meanwhile bond proxies like dividend-heavy telecom (XTL) and utilities (XLU) stocks have seen three straight weeks of outflows. Investors, nervous about the potential for rising yields have lightened positions in “long duration” bond funds for eight straight weeks, while “short duration” bond funds have seen eight straight weeks of inflows.

Duration is a measure of the sensitivity of a bond’s price to a change in yield (bond prices fall as yields rise and vice versa). The longer the duration, the bigger hit prices will take as yields increase. Many analysts have expressed concern that investors, hunting desperately for yield, have overexposed their portfolios to duration risk, leaving the potential for a shock if yields rise.

The 10-year U.S. Treasury yield TMUBMUSD10Y, -1.29% is up nearly 40 basis points, or 0.4 percentage point, from its post-Brexit low. The yield traded near 1.74% on Friday and briefly topped 1.8% earlier this month. Yields remain historically low, but with central banks around the world expressing a desire for steeper yield curves and analysts seeing signs of inflationary pressure, shifting flows aren’t a huge surprise.

As noted, traders and economists have previously called for a sustained rise in yields only to see them set another round of unimaginable lows. Indeed, a large chunk of the global government bond yields remain in negative territory.

But inflation-wary economists say the signs this time are much more convincing. Slok noted that U.S. inflation is trending higher no matter how it’s measured (see chart below).

“With higher inflation in the U.S., and the [European Central Bank] moving closer to tapering, the term premium is about to normalize…Add the likelihood of a coming big increase in government spending in the U.S. and the upside risks to inflation and long rates are even bigger,” Slok said.

Courtesy of marketwatch.com