How 2016 Market Compares To Normal Election Year, And What May Be Ahead

This Election Year's Bullish Move Isn't All That Unusual

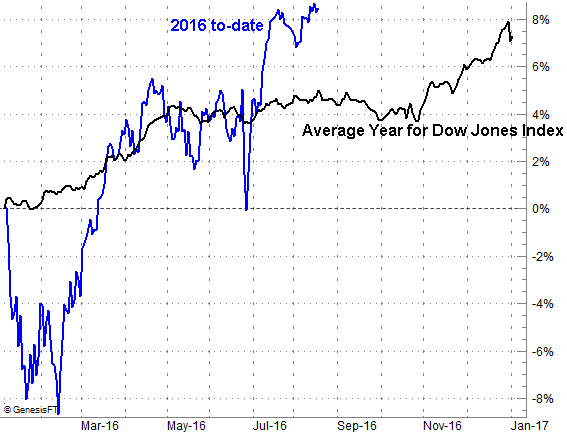

For those who understand the market can be cyclical with respect to the calendar, 2016 to date has been in some ways an unusual year. It started out with a move deep in the hole, but Dow Jones Industrial Average (INDU) (DIA) has since fought its way to greater-than-norm returns for this point in the year. As of the last look, the index is up 8.5% in 2016, compared to on average to be up 4.7% at this point in the year.

There's a good reason this year isn't the typical year, however. As it turns out, this year isn't all that unusual considering it's an election year.

The chart below compares the DJIA performance so far this year in comparison to the typical year for the blue chip index. As we mentioned, a rough start has been more than overcome.

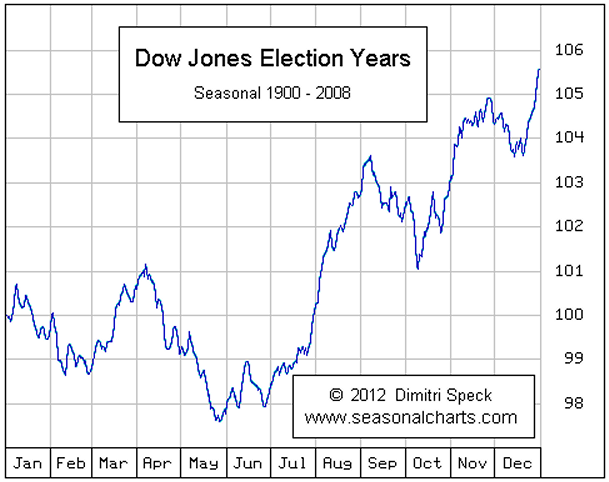

The chart below plot the typical performance of the Dow Jones Industrial Index during a Presidential election year. As you'll see, July and August are usually great during election years, even though they're normally flat. In election years, the market generally rallies all the way into early September.

But note that even the typical bullish election year doesn't sidestep the usual September weakness. Also, the further normal rebound in October leading up to and even after the election is impressive.

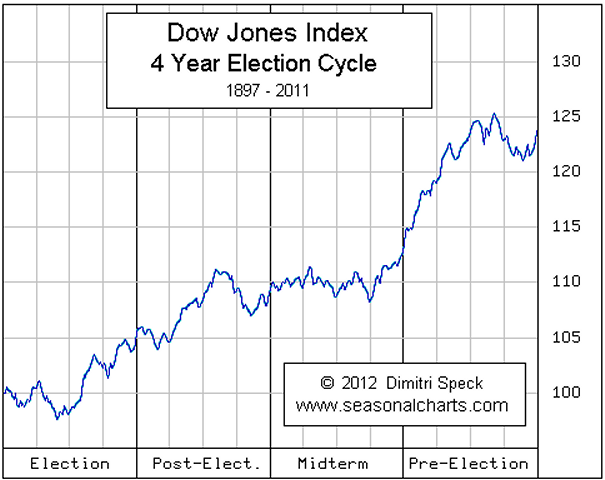

Broadly speaking, the path the Dow takes in an election year is more or less aligned with the average. It's a rarity for the market to actually log anything close to an average year though (meaning statistical outliers are the norm). As the chart below illustrates, each year of a four-year Presidential term has its own unique path. This election year truly isn't all that odd.

Is it all coincidental? It's unlikely the market is capable of moving with 100% correlation to a four year cycle, as the economy doesn't inherently ebb and flow in the same ways during a given timeframe. But, there is apt to be a psychological effect guiding the performance. As the campaigning progresses and the frontrunner's platform takes shape, investors start to develop faith in that plan, and position themselves accordingly.

It's still nothing you'd want to trade blind; exceptions to the norm are often the norm. On the other hand, one at least has to respect a tendency.