Ouch. Target (TGT) shares were off a painful 14% on Tuesday following the release of its disappoint fourth quarter results – the holiday shopping season didn't go well. How bad was it? Bad. But, to really get a grasp on how rough it was in Q4, one has to look at the company's deterioration in pictures as much as words. Here's a closer look at three images that truly are worth a thousand words each.

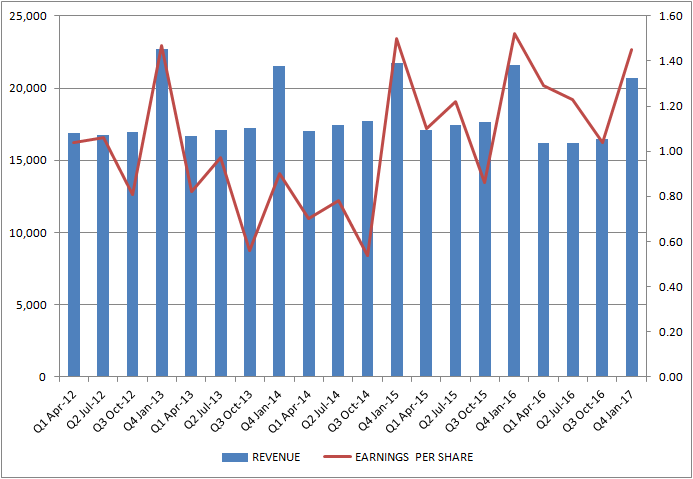

For the quarter ending in January, the struggling retailer's earnings of $1.45 per share fell short of the expected $1.51, and was down from the year-ago profit of $1.52 per share of TGT. Revenue-wise, the top line of $20.69 billion was shy of the analyst-expected $20.71 billion, and came up well short of the prior year's Q4 sales total of $21.62 billion.

The chart of the top and per-share bottom lines tell the tale. At first glance it looks healthy enough, but a closer, more scrutinizing examination clarifies that the numbers have been weakening on a year-over-year basis since 2014.

But the per-share profit tally is actually more up than down? Keep reading.

In terms of absolute income, the picture is even more alarming. Net income fell from $1.42 billion to $821 million last quarter; stock buybacks artificially inflated the per-share profit figure. There were 8.2% shares in the float last quarter then there were a year earlier.

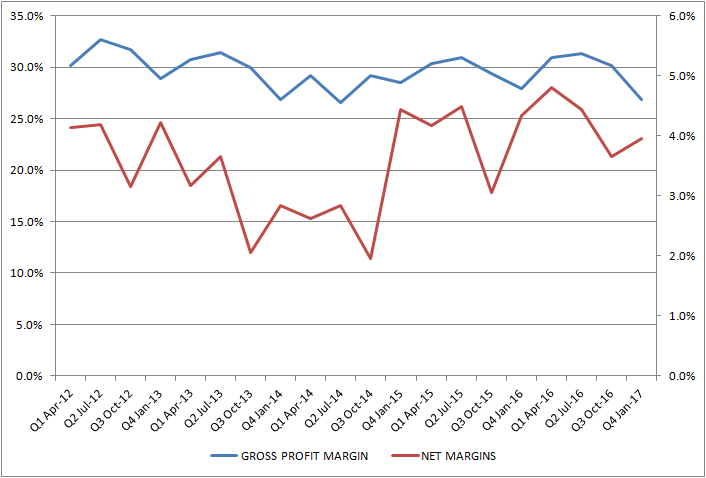

This headwind becomes evident on the chart of gross margins and net margins. While net margins were up from Q3, they were down from the prior year's Q4. Gross margins fell to the lowest level since 2014, and in that CEO Brian Cornell just declared a price war on Target's competition, this metric may not get any better anytime soon.

Target shareholders were less than thrilled with the results, sending TGT to a multi-year low with one swift blow.

For traders, the move — and the big gap it left behind — present something of a conundrum. There's no denying Target is fighting an uphill battle, but Tuesday's beat-down and the big gap would normally be seen as a buying opportunity. There's a difference between undervalued and cheap-for-a-reason though, and in this case, Target shares may well have gotten exactly what they deserve, and are priced at the appropriate value for the company's plausible future. That is, dead in the water.

To fully appreciate just how devastating today's blow was to Target shares though, one has to zoom out to a weekly hart. It's in this timeframe we can see the stock not only broke under one support line but two.

Realistically speaking, there's arguably more upside in TGT than downside here, but only because it's been beaten down so badly…. well before today's drubbing. Make no mistake though – that would only be a dead cat bounce.

The onus is now on the bulls. If we're to take any bullish effort seriously (meaning interpret it as long-term bullish momentum), TGT would have to get back above the 100-day and 200-day moving average lines both of which are currently right around $70.00. What an amazing trade TGT could be in the meantime though. That could be an eleven point move from where it is today, even though it would require a very short leash.