If gold gets below $1,250 an ounce, start buying: Goldman

Physical demand will limit the selling, say analysts

Gold (GLD) is facing a nearly 5% loss this week, its biggest weekly drop since November 2015, but Goldman Sachs is telling gold bugs to hang on.

The reaction in gold prices to the possibility of a U.S. interest-rate hike at the end of the year has been “larger than we anticipated,” said Goldman analysts Max Layton, Mikhail Sprogis and Jeffrey Currie, in a note released Friday. That leaves risks surrounding their year-end outlook of $1,280 an ounce as “moderately skewed to the downside,” said the analysts.

And while they still think U.S. real rates will rise into the year-end, they say gold has a couple of things going for it that will limit the selling: stronger exchange-traded fund buying and demand for gold bars, which will both likely remain intact, along with strong physical demand. Add the potential for a pickup in Chinese investment demand for gold to the mix, too, they said.

“Indeed, we would view a gold selloff substantially below $1,250/oz as a strategic buying opportunity, given substantial downside risks to global growth remain, and given that the market is likely to remain concerned about the ability of monetary policy to respond to any potential shocks to growth,” said the Goldman team.

December gold GCZ6, +0.11% was up $5.70, or 0.5%, to $1,258.70 an ounce on Friday. Prices settled down 1.2% to $1,253 an ounce on Thursday, just below the metal’s 200-day moving average of $1,256.12 and the fifth straight drop. Gold futures had not settled below their 200-day moving average since Feb. 2.

Gold is trading at around $1,250 per troy ounce as the week draws to a close and as such is facing its biggest weekly loss since November 2015.

Mostly upbeat economic data kept the negative noises around gold alive on Thursday, pushing those prices lower.

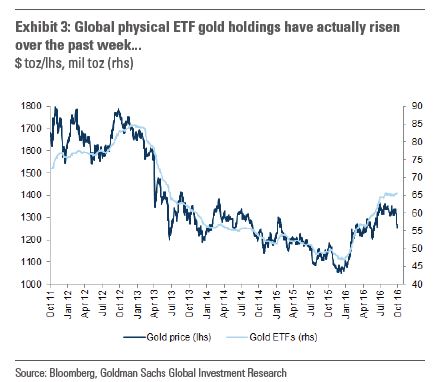

The Goldman analysts said they’ll be closely watching the degree to which Comex speculative positioning has corrected over the past week, noting that over the past week ETF holdings have risen:

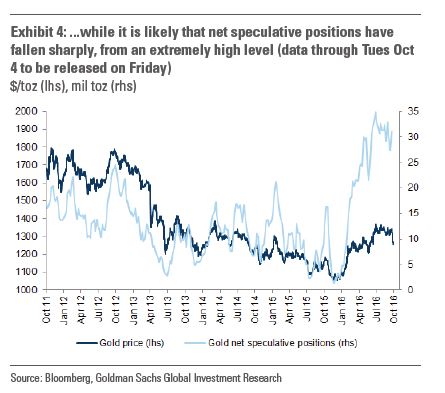

While speculative positions have probably fallen, they said:

Courtesy of marketwatch.com