Goldman Downgrades Stocks & Bonds To 'Underweight'

Posted by Bigtrends on September 16, 2016 2:24 PM

Goldman Downgrades S&P 500, Stoxx 600 To Sell, Cites 'Elevated Valuations And The Risk Of Shocks"

by Tyler Durden

The gloves finally come off.

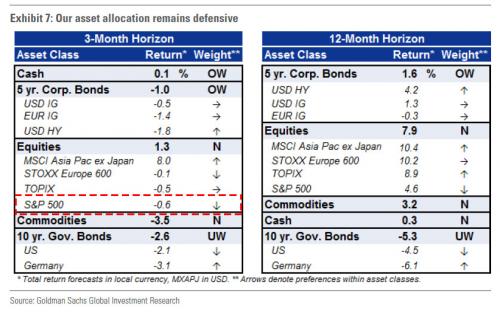

After tactfully warning clients for months that staying invested in US stocks and bonds is an unacceptable risk, overnight Goldman's Peter Oppenheimer finally changed Goldman's official "tactical" bias, and as of this moment recommends selling not only bonds, as well as the S&P 500 (SPX) (SPY) and Europe's Stoxx 600 "due to elevated valuations across assets and the risk of shocks."

Here is the full list of Goldman's latest recos:

- We are Underweight S&P 500 as we see strong positioning, headwinds from the resumption of the Fed rate hike cycle and a strong Dollar (UUP), and increasing political uncertainty into the US elections.

- We are also Underweight Europe into year-end due to elevated political uncertainty (from Brexit and the Italian referendum) and uncertainty on ECB policies. A ‘no’ vote in the Italian referendum (a 40% probability, in our view) could put pressure on Italian risky assets, in particular banks, and increase political uncertainty in Italy and the Euro area.

- Negative macro surprises and the global bond sell-off since last week have driven a reversal of the ‘Goldilocks’ summer rally. Risk parity and balanced funds suffered in particular, with a sharp increase in equity/bond correlations. We think bond yields will increase more until year-end, and downgrade bonds (TLT) to Underweight on a 3-month horizon (in line with 12-month). However, while rate volatility could pick up in the near term, we expect the most pressure in the back end and continued anchoring of the front end by central banks next week.

- We remain defensive in our asset allocation and Overweight cash (3m) due to elevated valuations across assets and the risk of shocks. However, we upgrade equities back to Neutral on a 3m basis due to support from still low rates and optimism on fiscal easing stabilising LT growth expectations. We continue to expect ‘fat and flat’ returns but our equity strategists now forecast less negative returns. Risks are still skewed to the downside in the near term, in our view, owing to more bullish positioning and the fading ‘Goldilocks’ backdrop. However, we see a lack of catalysts for a material drawdown.

- With central banks anchoring rates and a pick-up in macro data, we would expect equities to stabilise. The sensitivity to US 10-year yields across assets is close to the highest level since the 1990s. And risky assets tend to benefit from higher rates as long as they come alongside better growth; the correlation of risky assets with US breakeven inflation is more positive than with real yields. But, elevated rate volatility often results in a negative correlation of equities with higher yields initially.

- We stay Neutral commodities, on both a 3- and 12-month horizon. In the near term, fading supply disruptions in Nigeria, Iraq and Libya could drive more volatility in oil prices (see More worried about a thaw than a freeze, August 22, 2016). We continue to like Gold (GLD) as a diversifier, as correlations with equities are negative; however, near-term Gold is also at risk from higher yields.

Courtesy of talkmarkets.com