‘Godfather’ of Chart Analysis Says Trump Rally Has Another 5% Pop Left

Acampora thinks Wall Street is a believer in Trump pro-business promises

By Mark DeCambre, MarketWatch

Prominent market technician Ralph Acampora thinks the stock market has more room to run over the near term, despite a trend that has seen the Dow steadily walk back from the psychologically significant level of 20,000.

Acampora told MarketWatch on Monday that the Dow Jones Industrial Average and the S&P 500 index still have another 5% rise in them over the next several months. That would take the Dow to around 20,750, handily breaching 20,000, from its current level of about 19,790, while the S&P 500 would hit around 2,370 from 2,260.

He acknowledged that a recent stall has been “frustrating,” but maintains a bullish near-term outlook.

“The market has been in a tighter trading range for what seems like forever, but from a technical standpoint, I don’t see any major deterioration [in the upward trend],” he said. “I think the market is marking time” before it heads higher, he said.

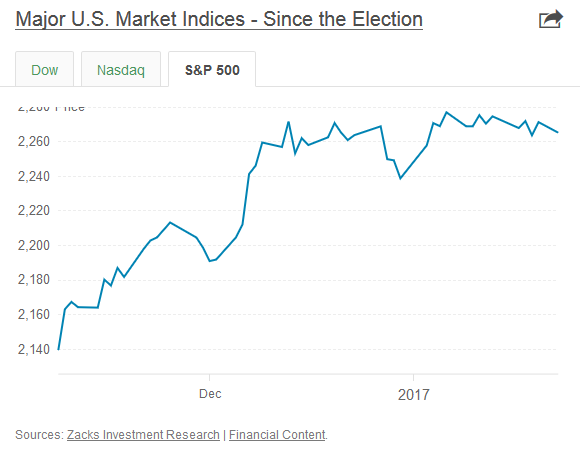

Since Trump stunned the world by beating out Hillary Clinton on Nov. 8 to win the presidency, the S&P 500 has advanced 6.2%, the Dow has climbed 8%, while the Nasdaq Composite Index has rallied 6.7% during that period. That ascent was supported by a raft of pro-business policies promoted by Trump, including a rollback of regulations, tax cuts and trade policies that are intended to put U.S. interests first (see chart below).

Market technicians tend to examine signals in an assets’ trading momentum to determine the likelihood that it will head higher or has reached a peak and is ready to sell off. Many technicians assume a trend remains in place until a significant technical level, among other factors, has been breached.

Acampora’s line in the sand for the Dow is the Jan. 19 intraday low of 19,677. Heading below that level, among other factors, might signal a reversal or bearish trend has taken hold in the blue-chip gauge.

Acampora, a pioneer in the field of technical market analysis, who is known affectionately around the world as the “godfather of technical analysis,” said Wall Street will continue to be emboldened by Trump’s policy promises.

“It’s the rebirth of capitalism,” Acampora said. “That’s what Trump is doing,” he said. Personally, Acampora isn’t a Trump booster. “Personally, I think he’s a jerk…, but if he does half the things he’s talked about doing—my God!” He said referring to Trump’s proposals to cut corporate taxes and loosen regulation as sparks for growth in the economy and market.

Trump doubled down on his hard-charging stance in his inaugural address Jan. 20. “Every decision on trade, on taxes, on immigration, on foreign affairs, will be made to benefit American workers and American families,” he said.

Those remarks spooked some investors with global stocks, including the Stoxx Europe 600 Index, the FTSE 100, and Germany’s DAX 30 and the U.S. dollar weakening, as the U.S. president’s comments were interpreted as protectionist and nationalistic—and threatening to upset the global trade dynamic.

Read: Investing legend Jim Rogers says dump stocks if Trump launches trade war

During a morning meeting with titans of industry on Monday, Trump punctuated his tough talk on trade—later, signing executive order that withdraws the U.S.’s support for the Trans-Pacific Partnership—and warning of tariffs on imports for corporations that shift jobs outside of the U.S.

Growing doubt about Trump’s ability to make good on his legislative agenda and his tendency to operate outside of conventions normal for the person holding the nation’s highest office, have been cited as reasons for the pause in equities and the recent rise in the havens like gold to a 10-week high and the decline in yields of benchmark Treasurys like the 10-year note.

The incoming Trump administration has given Silicon Valley a headache, mainly due to potential plans to penalize companies that manufacture goods in China. But not all of Trump's proposed policies may have a harmful effect on the tech sector.

Still, Acampora said a near-term jump in stocks may be followed by a bearish turn lower, but he sees the multiyear bull market for equities rallying back to new highs from those levels.

Contrasting views on the impact of Trump abound.

Other, high-profile market gurus have been much more cautious, including DoubleLine Capital’s Jeff Gundlach, who said investors ought to head East for investment opportunities. Billionaire George Soros also warned that global markets are likely to see a big selloff to under Trump.

Courtesy of MarketWatch