Watch Long-Term Oil & 3 'No Brainer' Energy Stocks

Watch Long-Term Oil & 3 'No Brainer' Energy Stocks

by Mark Hulbert

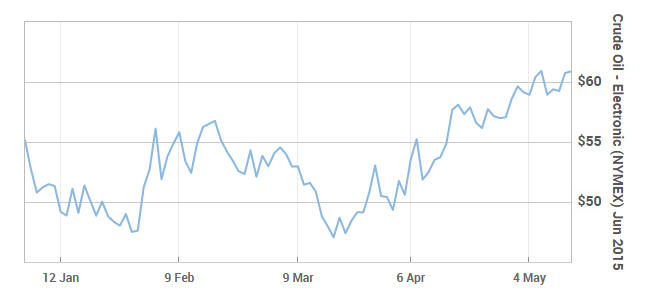

You ought to hold the oil stocks (XLE) you bought earlier this year when crude oil (USO) hit its low around $45 per barrel.

That, at least, is the advice Kelley Wright is giving to clients who think crude's 30-plus percent rally in only two months' time is too good to be true - and who therefore want to sell the oil shares they bought at lower prices. Wright is editor of the Investment Quality Trends advisory service.

Wright, insists that now is not the time to give up on good-quality oil stocks. Interestingly, though, his rationale for holding them is not that oil's price will continue to rise at anywhere near the pace it has over the past two months. Rather, he believes that a select group of oil stocks are in such strong financial shape that they represent good value and, notably, will continue to pay dividends, even if oil's price were to pull back.

To come up with his list of compelling oil stocks, Wright eliminates from consideration any that don't jump over at least five of the following six hurdles:

* Has increased its dividend at least five times over the past dozen years

* Has an S&P Quality Ranking in the "A" category

* Has at least 5 million shares outstanding

* Has at least 80 institutional investors

* Has paid dividends for at least 25 straight years

* Has produced higher earnings per share in at least seven of the past dozen years

Wright then narrows down his list even more by excluding those whose dividend yields are not at, or near, the high ends of their historical ranges. That's on the theory that the stocks with those high yields will be the most undervalued.

Which oil stocks remain after Wright applies these demanding criteria? In an email, he identified three as "no brainers."

- ConocoPhillips (COP)

- Exxon Mobil (XOM)

- Schlumberger (SLB)

By the way, I should stress that even though Wright believes those stocks would represent good value even if the spot crude price were to fall a bit, he is not forecasting such a pullback. On the contrary, he believes oil's average price over the next several years will be higher than it is today.

In that regard, it's worth revisiting another column I wrote, this one in mid-January, in which I pointed out that, while oil's spot price had plunged over the prior six months, a futures contract for delivery several years hence had fallen by only half as much. I quoted Campbell Harvey, a Duke University finance professor, who argued that investors should be focusing on the longer-term futures price rather than the spot market.

Harvey was right. Even as the spot price has roared 30% over the past couple of months, the long-term futures price has remained remarkably steady - quite similar to where it was in mid-January, in fact. That reinforces Harvey's argument, and puts the burden of proof on those who believe spot oil will plunge again to even lower lows.

Of course anything is possible, Harvey told me earlier this week, since oil's spot price often will fluctuate wildly even while the longer-term futures price remains relatively stable. But the market's best guess is that oil's price is headed higher over the longer term and, as we know all too well from everything we do in the investment arena, the market far more often than not is right.

Courtesy of marketwatch.com