Telecom Rebounds, Healthcare Rekindled, Tech Keeps on Truckin'

Things have changed for stocks since a couple of weeks ago.... mostly for the better. Some of the groups that had fizzled out have since rekindled. On the flipside, a couple have flamed out, with one of them doing so in a spectacularly disappointing fashion.

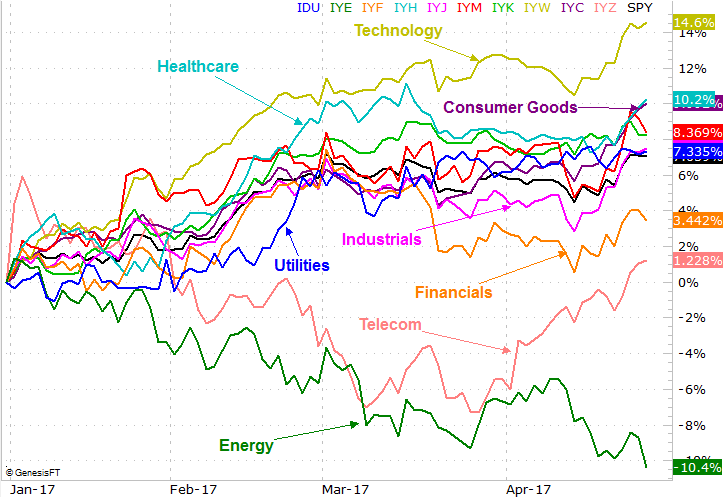

Traders would be wise to at least understand which sectors are leading and lagging now, as all big trends start out as small ones. The easiest way to spot new losers and winners is with a visualization of how each of the market's key sectors has performed compared to one another. We started the clock on our version of the chart at the end of last year.

Take a look. Though energy and telecom names got a rough start to 2017 while everything else rolled higher, by early April, both appeared to be on the mend. As it turns out, only one was on the mend... telecom. The energy sector has since rolled over and pushed its way into new lows.

There have been winners too, some of which were surprising. After a great start to the year, by late March it looked as if the big runup from healthcare was going to lead to some serious profit-taking. Those stocks have put it back in a bullish gear though, reclaiming their spot as the market's second-best performing sector for 2017.

Another stealthy winner is the consumer goods sector, currently in third place year-to-date. It's proven that slow-and-steady can win the race.

And of course, the technology sector was and still is leading the way... something unsurprising considering our look at how the market's FANG stocks are exerting more than their fair share of bullish influence on the broad market.

Everything else seems to be (still) stuck in the middle.

This particular chart is a powerful one simply because it can tell you so much about leadership -- and changes in leadership -- with just a quick glance. Acting on it presumes the apparent trends, new or old, will persist for the indefinite future, which as we all know doesn't always happen. But, there's a reason "the trend is your friend" has become a much-beloved axiom. Without a specific reason to expect redirection, it's not wrong to assume existing trends will persist until there's a clear reason to expect otherwise.

That being said, it's also not crazy to start preparing for reversals from the extreme outliers. In this case, that suggests energy stocks are positioned for a big rebound sometime, and that technology stocks will become a key profit-taking target in the foreseeable future. The challenge in that strategy is being patient enough to wait for the signs rather than trying to trade them preemptively.