Rising U.S. Shale-Oil Output Threatens OPEC’s Production Pact

Output in Permian Basin poised to lead jump

By Myra P. Saefong, MarketWatch

The oil market got a stark reminder Tuesday that rising oil production in the U.S. could upend efforts by major producers to bring global supply and demand for crude back in to balance.

Just ahead of the settlement for oil futures prices on the New York Mercantile Exchange on Tuesday, the Energy Information Administration released a report on drilling productivity—forecasting a monthly rise of 41,000 barrels a day in February oil production to 4.748 million barrels a day.

“That is bearish for oil and a concern for the Organization of the Petroleum Exporting Countries,” said James Williams, energy economist at WTRG Economics, pointing out that the volume of new oil per rig has climbed because of gains in efficiency.

“If maintained, the expected February production gain means production from the shale plays will be up at least a half million barrels per day by the end of the year,” said Williams.

Prices for February West Texas Intermediate crude lost the bulk of the day’s gain on Tuesday to settle with a modest 11-cent climb at $52.48 a barrel.

“Since rigs are higher now than in December and should continue to increase, that means a half million [barrel-per-day] gain in production by year-end is a conservative estimate,” Williams said.

“Most OPEC members expected this, but U.S. shale production will be the closest monitored data after OPEC’s own compliance with quotas,” he said.

OPEC reached an agreement back in late November to cut output by 1.2 million barrels a day to no more than 32.5 million barrels a day and other non-OPEC countries pledged cut production by nearly 600,000 barrels more.

Meanwhile, recent data from Baker Hughes (BHI) revealed that the number of active U.S. rigs drilling for oil, a proxy for oil activity, rose for 10 weeks in a row before edging down for the week ended Jan. 13.

Shale’s road to recovery

There have been concerns that the resulting rise in oil prices would provide incentive for U.S. producers to boost oil output.

But on Tuesday, speaking at the World Economic Forum in Davos, Switzerland, Saudi Oil Minister Khalid al-Falih played down those worries.

He said it would take time for U.S. producers to regain lost ground and that U.S. oil shale players “will find they need higher prices,” in part, because of higher production costs.

“Many of the folks at Davos think shale will kill the rally, but that really cannot replace all of the oil production that was wiped out” by cuts in capital expenditures in the oil market, said Phil Flynn, senior market analyst at Price Futures Group.

Al-Falih has also said he believes that the oil market will rebalance by the middle of the year, suggesting that the glut of oil will be gone in six months—so the market may need the shale oil, said Flynn.

All told, “shale is on the road [to recovery], but it will be a long road,” he said.

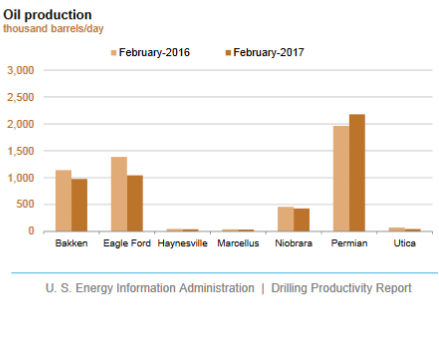

Permian Basin output growth

Still, the EIA report Tuesday showed that oil output from the Permian Basin, which covers parts of western Texas and southeastern New Mexico, is expected to see the largest climb among the big shale plays—53,000 barrels per day in February.

The Permian is the only shale play expected to see a year-on-year oil-output rise in February, according to the EIA report.

Given that, it’s no wonder that Exxon Mobil Corp. XOM, +1.17% also on Tuesday, announced plans to more than double its Permian Basin resources to six billion barrels of oil equivalent through the acquisition of companies owned by the Bass family. As part of the deal, Exxon Mobil will make an upfront payment of $5.6 billion worth of shares, and a series of contingent cash payments of up to $1 billion, starting in 2020.

U.S. shale production is “a real threat” to OPEC, said Williams.

“At the current level, it is manageable for OPEC, but if price rises another $5-$10, the corresponding increase in U.S. drilling and production would counter most of their cut,” he said. “OPEC is walking a tightrope.”

Courtesy of MarketWatch