Crude Oil Could Soon Find Yet Another Tailwind...a Falling U.S. Dollar

Crude oil (USO) hit new multi-week highs on Wednesday, extending what's not become a three-month winning streak. All told, crude prices are up 78% since January's lows, and still going strong.

Wednesday's leg of the rally was founded on reports that the nation's crude stockpile was slimmed down by an even greater degree than expected. Falling import levels also helped to convince the market the glut was starting to wind down, sopping up some of the excess supply that up-ended crude prices over the past two years.

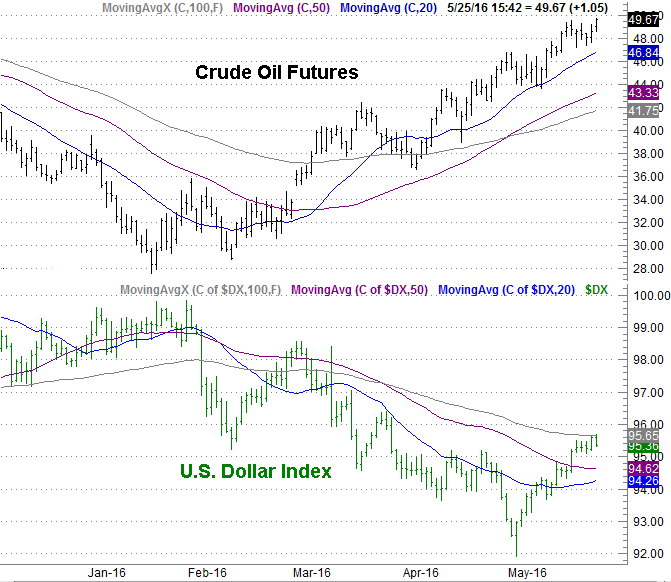

What's interesting , and telling, about crude's rally since early May is that for the first time in a long time it did so without the help of the falling U.S. dollar (UUP); the U.S. Dollar Index has bounced 3.6% since its multi-month low hit on May 3rd. That's a sizeable move for a currency.

The implication is, while a strong dollar may be largely the reason crude prices suffered between mid-2014 and early-2016, clearly it's not enough of a reason to hold the commodity back this time around. Said another way, perhaps it's no longer about the value of the dollar, but about actual supply and demand for oil.

That being said, to the extent a falling greenback would help boost crude oil prices, we may be on the verge of such a boost. As the U.S. Dollar Index has approached its 100-day moving average line (gray) it was already slowing down. And, now that it's touched it, Wednesday's bearish bar - more or less a mirror image of Tuesday's bullish bar - says that uptrend has already pivoted back into a downtrend. Though the rising dollar didn't hold oil back, a falling dollar is apt t be interpreted as yet another reason to keep buying crude. [Trading psychology is rarely symmetrical like that.]

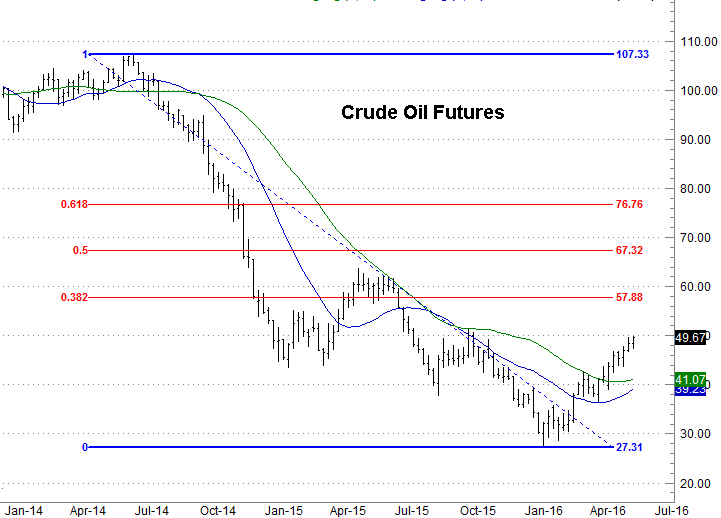

As for where it all may end, one has to take step back and look at a weekly chart of crude to really spot where oil is most likely to reach its psychological and technical peak. Beyond the ceiling right at $50 per barrel, where oil peaked in September of last year, the 38% Fibonacci retracement level at $57.88 supplies the most plausible ceiling.

Of course, there are no guarantees. Only odds and tendencies.