Brazil & Russia ETFs Continue Big 2016 Rebound

Impeachment? Invasion? No big deal for these two hot stock markets

Messed-up economy equals big stock market gains? The answer is yes, sometimes. What's going on right now around global stock exchanges is a prime example.

Brazil's yearlong political crises hit its crescendo in late August after politicians voted to remove its president, Dilma Rousseff, from office. It took months to actually oust Rousseff, who has been accused of illegally manipulating the federal budget by artificially enhancing a budget surplus. Headlines related to the scandal aren't slowing — former Brazilian president Luiz Inácio Lula da Silva is now being tried for corruption, too.

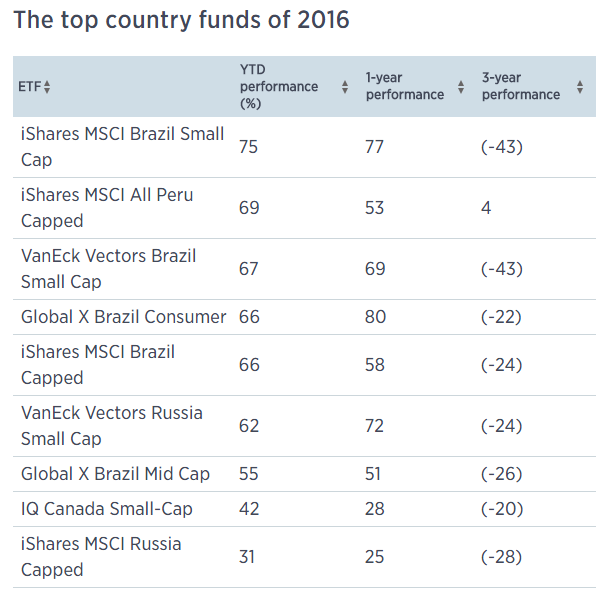

Yet year-to-date the Brazil stock market (EWZ) has climbed 66 percent, which is a major reversal from the 41 percent decline it experienced in 2015.

Russia (RSX) shares something in common with Brazil — they've both been hard-hit by the oil crash. Russia has also been busy invading neighbors as its petro-led GDP shrank by 40 percent year-over-year. But there's been no hangover in Russian stocks, which have seen massive gains — the VanEck Vectors Russian Small-Cap ETF (RSXJ) is up 62 percent this year, according to data from XTF.com.

Big drops in emerging economies are often followed by big gains. Maybe you've heard it put this way (not about the laws of physics but about stocks): What goes down must come up. It's a trading insight with big, opportunistic profit implications. Though admittedly, not for the feint of heart.

Russian stocks on the march

It can be hard to predict where any emerging market will go, but that's especially true for Russia, which has a leader that invades countries seemingly at will and relies heavily on oil for revenues. In fact, these are the two main reasons why the Russian market has struggled so much — the broad-based iShares MSCI Russia Capped ETF (ERUS) is down 28 percent over the past three years, but there's a 31 percent positive run this year included in the three-year number.

Its decline began in February 2014, when Russia invaded Ukraine, and despite a brief bounce back in June, it kept falling as the crisis continued to escalate. Then, in the fourth quarter of 2014, oil prices started to plummet from more than $100 to about $30 by the end of 2015. The country's currency also took a massive hit, which made imports much more expensive, and its inflation rate soared.

Now as commodity prices have stabilized, the Russian market has turned around. The currency has strengthened, while Russia's incursions into neighboring nations are not getting as much attention. Make no mistake, it's still mired in a host of issues, including economic sanctions, noted Gregg Wolper, a senior mutual fund analyst with Morningstar. But investors have started taking a calmer approach to its markets.

"People are evaluating the effects of sanctions better now," Wolper said. "Certainly, things have not cleared up and aren't in good shape by any means, but from an investor perspective some people feel more confident putting money in Russia."

Louis Lau, an emerging markets–focused portfolio manager at Brandes Investment Partners, which has $26 billion in assets, has a 9 percent weighting in Russia. Lau said while valuations have come up slightly from the five-times earnings lows Russian stocks saw last year, there are still opportunities. He has holdings in Russian telecoms, which are seeing growth in services and data usage, and he's keen on Russian oil companies, too. Companies in the sector have cut costs, reduced capital expenditures and increased volume, Lau said. They'll benefit from rising oil prices, and some also pay attractive dividends.

Of course, when it comes to global investing, it can be notoriously difficult to predict which countries will be up and which will be down in any given year. Wolper said that more diversified investing, through broader-based global funds or a general emerging markets ETF, might be a better way to go, but if you do want to make a bet on these three countries or any other ones, know what you're getting yourself into. "You can hit it really big or can lose in a frustrating way," he said. "Keep the allocation to a small percentage of your overall holdings."

Debt-to-GDP at 67 percent? No problem!

Brazil, South America's largest country, has been rocked by more than just political scandals. In 2014, news came to light that Petrobras, its major oil and gas company, allegedly overcharged a cartel of companies for construction and service work. Senior politicians then received kickbacks from the companies who were awarded those contracts.

While the company is 51 percent government-owned, shares dropped by 68 percent between 2014 and the end of 2015, and the Brazilian stock market fell with it. Rousseff was actually on Petrobras' board of directors during the time the alleged corruption took place. "It dented people's faith in business and politicians," Wolper said.

Being a commodity nation — not just oil but metals as well — hasn't helped. Falling oil and iron ore prices had a big impact on government revenue, and the national debt-to-GDP level is at a sky-high 67 percent, driven in part by continued spending in a declining commodity environment. Brazil descended into one of its worst recessions in 2015.

While many of these issues still exist, the investing case for Brazil worked because of the bounce-back effect and, more specifically, hopes that a new administration would lead to a further rally. Year-to-date, Petrobras shares are up a whopping 122 percent, but of course, it took a massive fall and losses for shareholders for that to occur.

"People have been looking for something positive," Wolper said, and hope that the new president, Michel Temer, will institute a number of financial reforms, like budget and wage cuts and pension benefit reductions.

More stable oil prices and a strengthening of its currency — the U.S. dollar has fallen by roughly 20 percent versus the real year-to-date — has also helped lift markets. There's an expectation that interest rates, which are at 14.25 percent, will start falling soon — recent economist expectations are for a one-percent decline to 13.25 percent.

For these reasons, Lau has an 18 percent overweight to Brazil. While he has started selling some of the stocks that have done well, such as in utilities and construction, he still thinks there's value in the Brazilian stock market. And if it does exit its recession, which he expects will happen next year, many parts of the market will continue to do well, Lau said.

What comes after a 36.8 percent decline

Politics and stock prices are often intertwined when it comes to emerging markets, especially around elections.

In 2015 the race for the next Peruvian president began, and that made markets nervous, Lau said. Would the next president continue on with the pro-business policies of the last leader? It turns out the new president, Pedro Pablo Kuczynski, elected in June after two rounds of votes, is indeed supportive of businesses, according to Lau, and that has helped returns rise.

The iShares MSCI All Peru Capped ETF (EPU) is up 69 percent this year — but previous years' underperformance places its three-year return at 4 percent. Notably, it's the only of the top-performing country funds this year that has a positive performance over a three-year period.

The country is also a big exporter of copper, and its price has been under significant pressure due to the slowdown in China. In 2015 the commodity plummeted but this year prices have been less volatile — year-to-date a broad-based ETF tracking the global copper market is up 6.4 percent. A better political climate and calmer commodity markets have been a boon for the country. "The outlook for Peru has become much more stable," Lau said.

Because it is one of the fastest-growing Latin American countries — Peru's central bank expects the economy (last year's GDP growth was 3.3 percent) to grow by 3.7 percent in 2016 and 4.2 percent in 2017 — valuations are higher there than in other places, in the Brandes manager's opinion. That could be good for growth investors, who may find opportunities in the busy construction sector, but as a value manager, Lau isn't finding a lot of buys. "With higher multiples and more growth ahead, I do think Peru will be more attractive to growth managers," he said.

Courtesy of cnbc.com