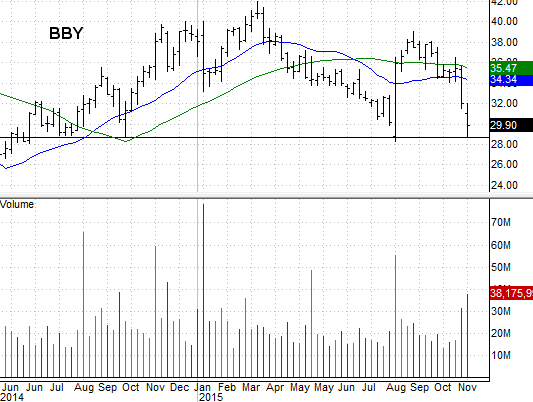

Best Buy (BBY) Heads Lower On Disappointing Outlook

Best Buy (BBY) Still Unable to Produce Revenue Growth

Electronics retailer Best Buy (BBY) may have grown its bottom line and topped earnings estimates last quarter, but nothing else about its Q3 results or its Q4 outlook were acceptable in the eyes of investors, who sent BBY shares sharply lower on Thursday.

All told, Best Buy earned an adjusted 41 cents per share on revenue of $8.82 billion in its third fiscal quarter of the current year. Income topped estimates of 35 cents, but sales fell short of the expected $8.83 billion. The company earned 34 cents per share on $9.38 billion in revenue in the same quarter a year earlier. Same store sales were up 0.5%, missing the anticipated growth rate of 1%.

The current quarter's numbers aren't expected to be any less disappointing. Best Buy said it believes revenue will be flat to slightly negative (a low single-digit dip) in the fourth quarter, leading to a very slight decline in year-over-year income.

The results and outlook call into question the turnaround effort that's been in place, largely led by CEO Hubert Joly, for three years now. Although the company is more profitable now than it was when he took over, all of that margin growth has stemmed from cost cuts; sales have continued to dwindle the whole time he's been at the helm.

On the flipside, the sharp plunge from BBY shares today was stopped at an established floor near $28.65. This is the third time in a little over a year this level has acted as a floor, and as such may be a key make-or-break line; much of the downside made evident by today's earnings news had already been factored into the stock's price.