Why one prominent hedge-fund boss is calling this 'the biggest bond bubble' ever

The “biggest bond bubble” ever. That is how Paul Singer, one of Wall Street’s most prominent hedge-fund managers, referred to the fervor to scoop up fixed-income investments, like government bonds.

Who can blame Singer? MarketWatch has mentioned this before, but central banks around the globe have rolled out unprecedented measures, including purchasing corporate and government bonds, in an effort to shock their wobbly economies to life and end a period of low inflation.

As a result, yields on trillions worth of bonds around the globe have been pushed into negative territory as central banks purchase debt and other securities in an attempt to drive down borrowing costs, push investors into riskier assets and spur economic growth.

An August report from Fitch Ratings indicated that some $11.5 trillion in government debt sported negative yields. The 10-year benchmark U.S. Treasury TMUBMUSD10Y, +3.21% (TLT) was yielding 1.53% Thursday afternoon in New York, while the German equivalent, known as the bund TMBMKDE-10Y, +62.83% was yielding negative 0.08%. Bond yields and prices move in the opposite direction.

As CNBC’s star reporter Kate Kelly writes, Elliott Management’s Singer offered his view about the state of the bond world in a recent letter to clients, which shows that his $28 billion fund is up about 6% through July. That is not too shabby considering that most funds have been struggling to eke out significant gains. According to hedge-fund data provider Hedge Fund Research, the average hedge fund is up about 3% through July.

But Singer’s performance isn’t spectacular compared with the S&P 500 index SPX, -0.14% (SPY)which has climbed nearly 7% year to date. The Dow Jones Industrial Average DJIA, -0.20% (DIA) is up about 6.6%, while the Nasdaq Composite Index COMP, -0.03% has returned 4.6% so far in 2016.ly.

A request for comment from Elliott Management wasn’t immediately returned.

By and large, hedge funds have struggled during this period in which central-bank policies have underpinned Wall Street’s moves and investors’ attitudes.

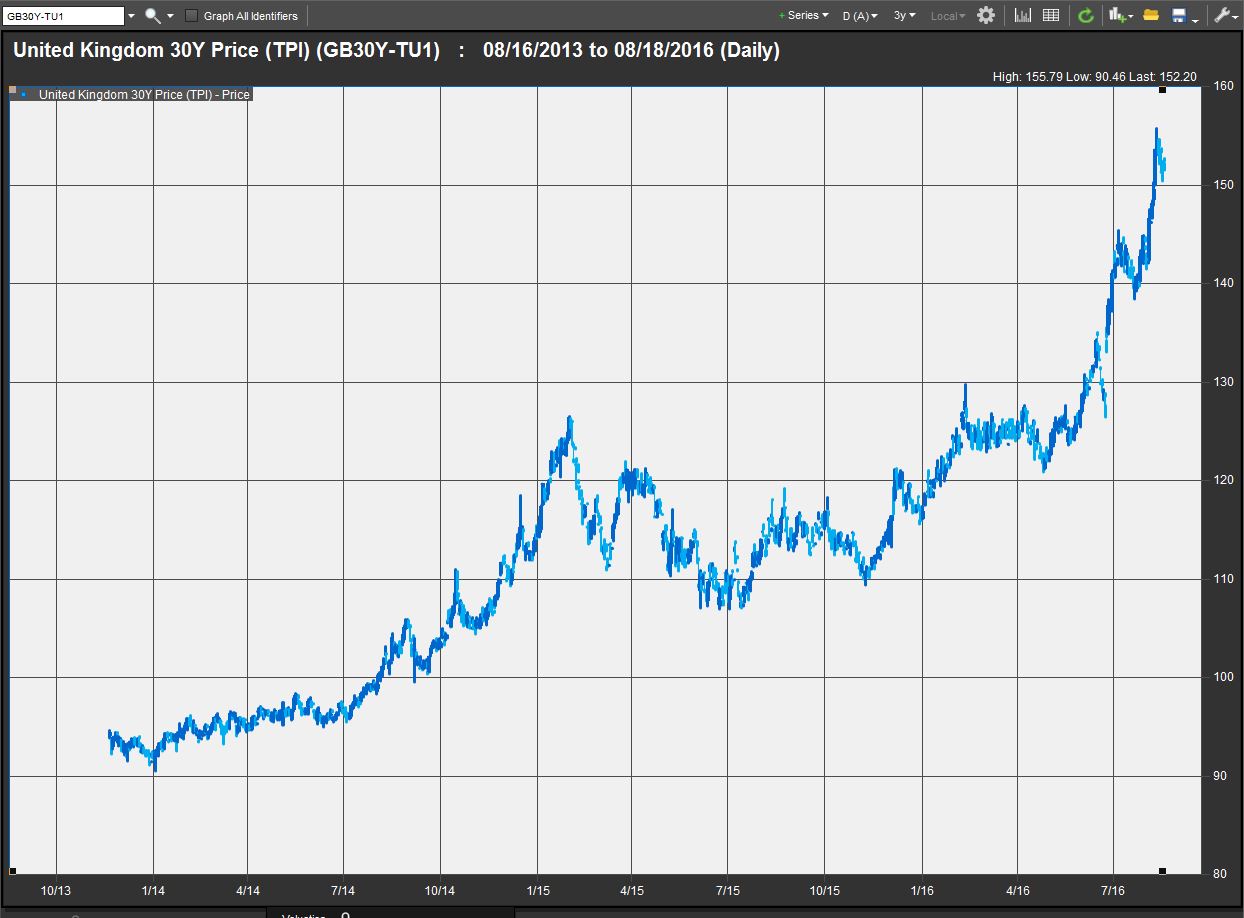

“I think central banks have overshot” said Robert Tipp, chief investment strategist at Prudential Fixed Income. He noted that Bank of Japan, and most recently the Bank of England, have seen long-duration bonds soar in price, with yields plunging. For example, British 30-year government paper has surged from around 92 three years ago to 152, as of Thursday, according to FactSet data (see chart below). Par, or the face value, of a bond is 100.

Those gains in U.K. bonds have come as the BOE has revived its bond-purchasing program in an effort to mitigate the effects of the U.K.’s June 23 decision to abandon the European Union.

Echoing comments from other pundits and star money managers, Singer says the bubble in bonds could prove financially fatal for investors, who have been forced to pile into investments they deem safer than most.

Singer warns that “the ultimate breakdown (or series of breakdowns) from this environment is likely to be surprising, sudden, intense, and large.”

What’s the big worry? A sudden move in rates that in a crowded trade could leave investors with brutal losses.

Fitch’s analysts estimate in an Aug. 2 report that a hypothetical reversion by interest rates to 2011 levels could result nearly $4 trillion in losses.

Janus Capital’s Bill Gross has likened such a scenario to a supernova that could explode one day.

In other words, investors have been duly warned.

To be sure, not everyone is seeing bubbles in bonds. “ The only bubble out there is the use of the of the world ‘bubble’,” said Guy LeBas, chief fixed income strategist at Janney Montgomery Scott.

LeBas also disputes the idea of a bubble in bonds on technical terms. His argument is that unlike some assets that might see infinitely higher values in the future (at least, as much as investors are willing to pay), bonds have a finite value because of their maturities.

“At some point in the future that value is going to come back to par” he said.

Courtest of marketwatch.com