5 ETFs That May Rally In This 2013-Like Enivronment

It looks like 2013 all over again - which means you should buy these 5 ETFs: Technical analyst

by Annie Pei

Recent market trends have one technical analyst suggesting that it could be time to look at some of the most high-risk sectors.

With the market slipping recently due to worries that the Federal Reserve will raise rates as soon as next week, Oppenheimer technician Ari Wald is reminded of similar market activity from three years ago.

In May 2013, anxiety over the potential the Fed might cut down on quantitative easing led to the "taper tantrum," causing the S&P 500 to fall by almost 6 percent. Shortly afterward, however, the S&P surged 9 percent.

The same trend could be underway, says Wald, who also makes the case that investors ought to look into the market's riskier ETFs. When the market performs well, cyclical sectors typically lead the way.

"If you look at what's driving us lower, it's really been a lot of your bond proxies. Your utilities, and telecom, and consumer staples sectors, your more defensive areas of the market," he explained Tuesday on CNBC's "Trading Nation." "We're making the case that this volatility is actually creating an opportunity to buy more cyclical and risk-on areas of the market that are less influenced [by interest rates] and can actually benefit from rising interest rates."

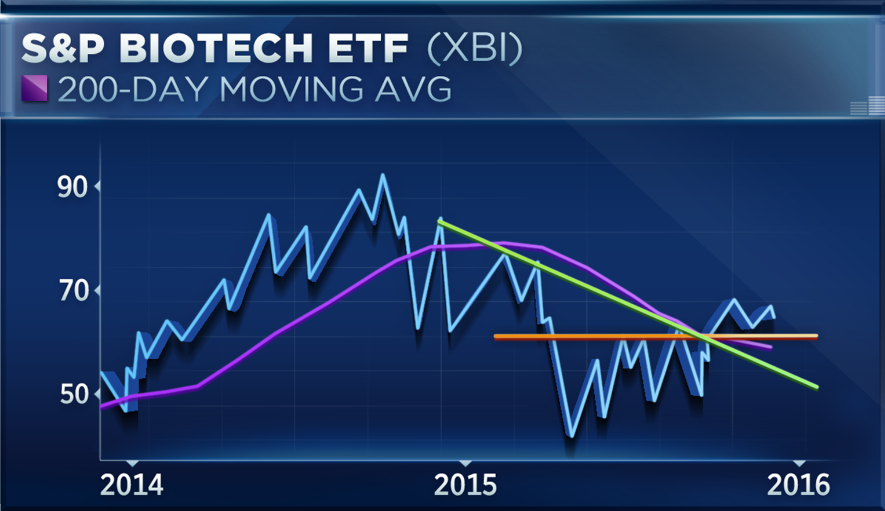

According to Wald, the star among those sectors is biotech. A chart of the S&P biotech tracking ETF XBI (XBI) (IBB) (XBT) shows that while the market has been down since last Friday, biotech has held. The XBI specifically broke through a downtrend line and has broken through a $58 resistance level, according to Wald.

"Here's an area less influenced by this rise in interest rates, and looking at the chart we see a trend that is reversing higher," said Wald.

Erin Gibbs, chief investment officer at S&P Global, believes investors should take the biotech bet from a fundamental standpoint. According to Gibbs, the average upside for stocks in the XBI is 30 percent from current target prices.

"It's trading really cheap, which explains why it hasn't been hit so hard in the market, because it's already trading at 12 times forward earnings," said Gibbs. "A lot of those stocks have already been beaten up and depressed, and you're seeing good values."

The XBI is down almost 10 percent this year, but has seen some recent strength.

Wald also suggests a number of other cyclical ETFs for investors to buy. A note released by Oppenheimer on Tuesday suggests that investors also buy ETFs tracking high-beta stocks (SPHB), oil exploration and production names (XOP) (XOP), transportation stocks (IYT) (IYT) and information technology (XLK) (XLK).

Courtesy of cnbc.com