Stocks are inching closer to the second correction of 2016

Anyone else remember how scary the first few weeks of 2016 were?

I know. That feels like forever ago. We went from the worst start for stocks in history to what has thus far been a pretty decent year for headline averages. High beta/cyclical sectors, emerging markets and inflation expectations have largely pushed higher against the backdrop of bond yields which (still) are not convinced of a better economic future. Everything for now feels calm.

The pre-election melt-up scenario I've laid out over the last couple of months has held true. But we may be nearing the exhaustion point in the near term. There are a few things concerning me here which could be very early warning signs that another bout of volatility VXX, +12.61% (VIX) (VXX) is coming sooner than later.

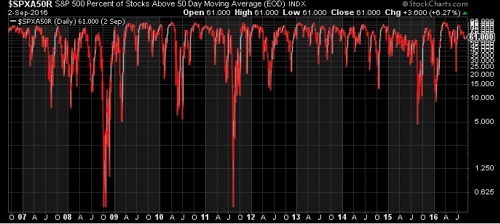

Among these concerns? Very quietly, the percentage of S&P 500 SPX, -1.93% (SPX) (SPY) stocks above their respective 50-day moving averages has been trending lower. This matters because as more stocks trend below their moving average, the more likely volatility is to increase among those stocks (something shown in our 2016 Dow Award-winning paper which can be downloaded here).

From an inter-market standpoint, utilities XLU, -3.07% (XLU) which have been quite weak in recent weeks, are at an important inflection point. Should relative strength renew in the relationship of utilities to the S&P 500, odds would also favor a period of increased risk. We've shown in our white papers before that utilities tend to be a leading indicator of a correction to come as market participants begin positioning in advance of what could be a drawdown in stocks.

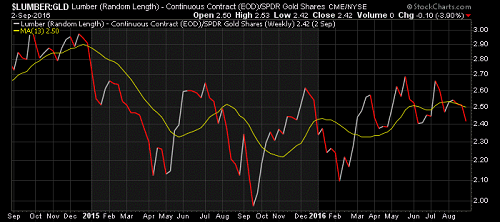

Finally, despite what appears to be a healthy asset market that one would think should benefit consumers and their demand for housing, Lumber relative to gold GLD, -0.56% (GLD) has begun to trend lower. Those who have attended my presentations on this or read our research know that this is important to track because when lumber (highly cyclical) begins weakening relative to gold (non-cyclical), it suggests expectations are lowering for domestic growth and inflation expectations.

We are inching closer to a risk-off period. I suspect that if these trends do not reverse in the coming days, we may start seeing renewed volatility spiking in the weeks ahead. Just like the time to be betting on a melt-up was during the pinnacle of fear in early February, we may be nearing the pinnacle of complacency as flashing red signals begins to warn the investment community of a second correction to come.

Courtesy of marketwatch.com