Many traders use a combination of tools and analysis to help them formulate their exit strategies. By doing this, they are seeking to identify the level at which to liquidate their position, and they are looking to use technology to help them close their trade at or near that level. For instance, a trader may use advanced technical analysis solutions to determine their sell target, then employ a stop order, which can trigger a sell when the position hits that level. It's important to remember that there is no guarantee that a stop order will be executed at or near the stop price.

But to put tools and technology to work, you need an approach or a general philosophy. Some traders are more analytical. Some are practical. Some are risk-takers. So naturally, as there are different kinds of traders, there are different approaches too. Here are three of those exist strategy approaches.

1. Find Support and Resistance Zones

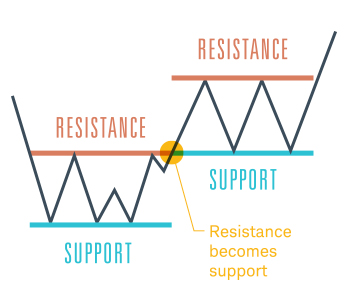

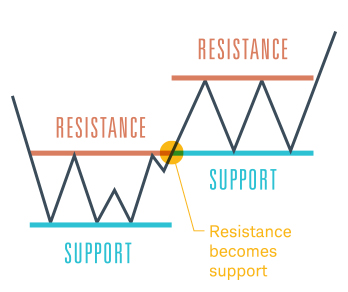

One approach to building an exit strategy is to use technical analysis and charting software to determine trend lines based on historical price. Armed with this information, traders may identify support and resistance zones, which may be potential entry and exit points. You can think of these zones as a floor and ceiling.

A resistance zone is a price zone the stock may repeatedly run up to without breaking through to new highs. A stock that reaches a resistance zone may consolidate within that zone for an extended period of time if bullish momentum cannot push the stock through that zone. Otherwise, if the stock breaks out of the resistance zone, a new bullish trend may be beginning and the resistance zone then becomes support.

A support zone is a price zone that the stock may retrace to repeatedly without falling below to new lows. Like resistance zones, a support zone may act as a barrier to new lows until enough momentum pushes the stock through the zone. If the stock breaks down and falls below the support zone a new Bearish trend may be beginning and the support zone becomes resistance.

Bollinger Bands® are also used to provide guidance about support and resistance zones. Bollinger Bands® are a Simple Moving Average with standard deviations of that moving average acting as the outer "bands", or short-term support and resistance zones. Bollinger Bands® may be used to identify trades or exit strategies in many ways, including potential breakouts or breakdowns. When the stock consistently trades at or around the upper band, traders may consider waiting for a breakout above the band or for the stock to fall back toward the moving average to establish a new position. Conversely, during a period of consolidation along the upper band, traders may close long positions and realize profits. If a stock is trading along the lower band, traders may be inclined to open a long position if the stock then starts appreciating in value. If the lower band is breached, a trader may exit a long position with the understanding that the short-term support zone is broken and will then become a resistance zone.

2. Let your profits run

Another exit strategy to consider: let profits run and cut losses short. This may feel counterintuitive to some traders whose instinct is to promptly exit a position that has risen quickly. Those traders are likely thinking that there is a profit to be had, and they do not want the trade to just as quickly turn against them. Likewise, some traders hold on to losing positions for an extended time in hopes the stock will recover. It makes sense: people like to profit, and they don't like to lose. So, they get out of winning positions quickly before the trade goes against them, and they stay in losing positions for a long time in hopes their trade may recover.

Of course, not every stock that rallies plummets. Some stocks continue to climb. And you may know all too well that some positions don't recover (in fact, they may even get worse over time). That's why you may consider the inverse approach to the win-quick/lose-long philosophy: let your winners run, and cut your losses quickly. The thinking behind this exit strategy states that a position is worth holding on to as long as it's gaining; and when it falls is when it should be sold.

However, stocks rise and fall throughout the day. Are you really supposed to sell on the first downtick? How do you know when it's time to get out? The answer is not an arbitrary one. Rather, it's a matter of your own personal appetite for risk. Many traders prefer to limit their risk to between 1 and 3% of their trading portfolio on a single trade. To apply this method, they calculate that amount and then determine how much a position must fall until the loss is equal to that amount. From there, they can set a trailing stop order. A trailing stop order will "follow" a position up, readjusting the sell trigger with every movement. So if a stock is bought at 10 with a trailing stop set to send a sell order one point below, the sell order will trigger if the stock falls to 9. However, if the stock climbs to 15, the sell trigger will be automatically adjusted to 14.

By determining your risk appetite and using a trailing stop, you may help limit your losses to an amount that is "acceptable," or even better: you may let your profits run.

3. Take Some Profit (But Not Necessarily All of It)

There's an old expression, "You don't go broke taking a profit." But keep in mind, you don't have to take the entire profit all at once. That's where scaling in and scaling out becomes useful. If you think you're getting close to the top but there's a possibility it has more to go, exit a portion of the position (scale out) and take some profits off the table.

Maybe you've got 1,000 shares. You could sell just 200 and hang onto the rest. By consistently scaling in and scaling out, you may end up doing better because you can lower your basis getting in and get out with an overall net profit. This way, if you miss the top of the price, you still make a profit.

This can be a particularly effective strategy in flat/low-volatility markets. Perhaps you entered a position believing it would rise to a level that it has not yet reached. Rather, the market is healthy, but not trending much. By scaling out, you can not only take some smaller profits, but achieve two other things: 1) keep some amount of that original position in case the market picks up again; and 2) reinvest a portion (or all) of your gains into another position (perhaps one with a little more volatility and/or opportunity).

Conclusion

An exit strategy can be both a profit-harvesting strategy and a risk-management strategy. They're just as applicable in low-volatility markets as they are in the higher volatility markets with big swings. You have many options when creating exit strategies for which your intention is to protect against losses and maximize profits. Formulating and executing on those strategies are often a mix of philosophy, technology, and tools. Whether you're identifying support or resistance points, letting profits run, or scaling in and out, sophisticated platforms such as StreetSmart Edge® with Recognia can help you simplify the process and pinpoint potential exits. Though when it comes to philosophy, that's entirely up to you, the trader.

Courtesy of cnbc.com