There's more in the tank for oil - look for a 10% rise: Technical analyst

by Annie Pei

Crude oil (USO) closed in on $50 per barrel, and one technician thinks the commodity can head even higher from here.

Crude settled at $49.83 on Wednesday, its highest close since June, as it struggled to surpass the key $50 level, which macro strategist Boris Schlossberg of BK Asset Management calls "psychologically important."

As much as traders and investors are watching for oil to hit $50, however, Strategas technical analyst Chris Verrone actually sees oil heading to $55.

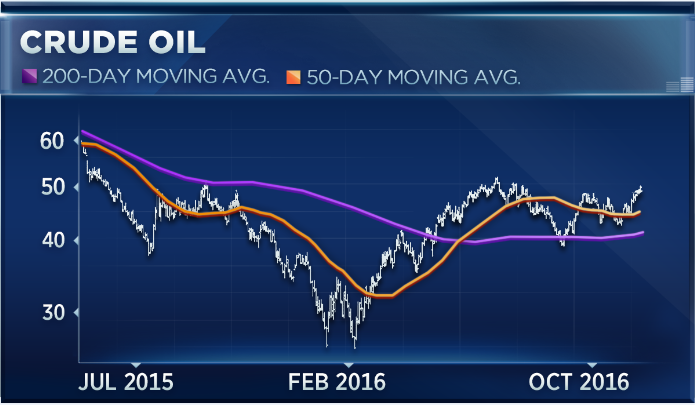

Referring to a chart of oil dating back to last July, Verrone says that while oil has gone almost nowhere for the past four months, crude did break through what he describes as a "key level" at $48.55 this week. In other words, Verrone believes that by breaking through what he sees as resistance at the 50-day moving average, oil can make new highs and hit $55 with buying opportunities ahead.

"I recognize that seasonality is not too favorable over the next several weeks, but I certainly want to look to any weakness as an opportunity to get exposure here," said Verrone on Wednesday on CNBC's "Power Lunch."

Boris Schlossberg, managing director of FX strategy for BK Asset Management, also sees oil heading to $55, though no higher, as he expects inventories to pick up soon. However, he does believe that the current oil rally is actually a positive signal for the economy.

More specifically, he points out that oil and the dollar (UUP) are currently moving together, not in opposite directions as they traditionally do, given that oil is priced in dollars, so that a rising dollar tends to mean that crude prices drop.

"The dollar and oil are moving lock and step, and I think the other reason for why that's happening is because it's sort of a boom trade," said Schlossberg. "It's a bet on the fact that the global economy is actually not slowing down as much as everybody thought."

Courtesy of cnbc.com